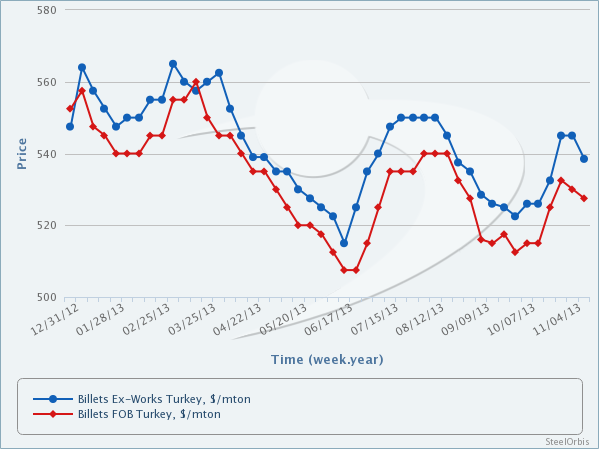

SteelOrbis has heard from market sources that billet demand in the Turkish domestic market has failed to record any improvement, while recent scrap bookings have contributed to the decline in local billet prices. Accordingly, local billet prices have softened by $10/mt since last week, decreasing to $532-545/mt ex-works. Meanwhile, local mill Kardemir's domestic billet sales, which were opened on November 7 at $532/mt ex-works for S235JR grade (St37) and at $537/mt ex-works for MT III-A grade billets, excluding VAT, have so far managed to attract demand for approximately 5,000 mt of billet in total. In the meantime, ex-Turkey billet offers are ranging at $525-530/mt FOB.

On the other hand, CIS billet offers to Turkey are still at $525-537/mt CFR, stable since last week and this sideways trend is expected to continue in the coming days. The downward trend of scrap prices has prevented import billet prices from recording upticks. Turkish buyers will likely conclude import billet deals in the range of $528-530/mt CFR in the coming period.

Weekly price movements of different steel products in major markets can be viewed comparatively in the SteelOrbis Historical Steel Prices section. Market trends can thus be seen more clearly, while desired charts can be created and used in reports or presentations.