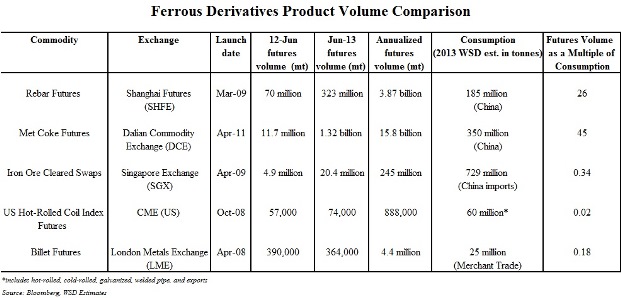

By 2016, hedging of the price risk for steel products and steelmakers' raw materials will become an almost-universal activity. Steel and steel raw material futures, and cleared swaps, have been around since 2008; they are traded on exchanges in the US, China (Shanghai, Beijing and Dalian), London, Hong Kong and Singapore. The volume growth in rebar futures on the Shanghai Futures Exchange (since 2009) and Metallurgical Coke Futures (since 2011) and Iron Ore Futures (most recently) on the Dalian Commodity Exchange are among the great success stories in the history of futures trading.

China's Dalian Commodity Exchange (DCE) launched its iron ore contract last October 18 and has traded 338,700 lots on its launch date. DCE's iron ore futures contracts are sold in lots of 100 metric tonnes, and priced in RMB per dry metric tons including 17 percent VAT, with a minimum delivery size of 10,000 metric tons. Ma'anshan Iron & Steel, a Chinese state owned mill has announced recently that it will begin trading iron ore futures on the newly established Dalian Commodity Exchange.

Although gains in steel futures volumes on the CME and LME have been modest, cleared swaps trading on the Singapore Exchange's (SGX) iron ore has had a significant volume growth in the past year. The SGX's success is noteworthy because it is clearing Chinese OTC (over the counter) swap contracts that are executed outside of China. The exponential rise in the SGX's iron ore swap trading volumes suggests that other Chinese outside-of-China products like steel scrap, hot-rolled band, metallurgical coal and metallurgical coke may experience accelerated growth in the years ahead.

Leaner margins are forcing the steel mills and their suppliers to find new ways to gain an "edge" over the competition. One solution, World Steel Dynamics believes, is for a company to develop disciplined and consistent hedging plans that include working closely with customers. Futures are universally accepted and employed in the non-ferrous world; they are viewed as indispensable by those who use them--especially the aluminum producers. The steel industry has had five years to "warm up to the idea" that steel and steel raw materials futures have merit.

WSD has been a futures advocate since 2005. In 2009, it formed World Steel Exchange Marketing (WSEM) to promote and obtain revenues from exchange trading of steel futures. WSEM signed a strategic partnership agreement with the NASDAQ OMX Futures Exchange (NFX) on May 1, 2013, and plans to launch the first of several new futures products in the months ahead.

We expect the WSEM/NFX marketing push will help accelerate the adoption of these financial tools by the industry. The unique combination of WSEM and the NFX brings together physical steel industry relationships and the financial trading community. WSEM provides hands-on hedging expertise, forward price curve analysis, and is committed to finding the right solution for client needs.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2013 by World Steel Dynamics Inc. all rights reserved