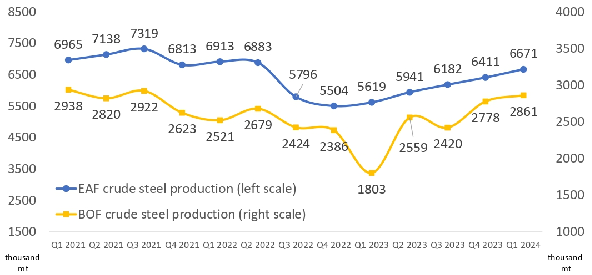

In recent years, the steel sector in Turkey has exhibited a different trend compared to the overall domestic economy. While Turkey's general economy grew by 5.6 percent in 2022 and 4.5 percent in 2023, the steel sector experienced contractions of 12.9 percent and 4.0 percent in those respective years. Globally, capacity utilization rates have fluctuated between 75 percent and 80 percent, whereas Turkish steelmakers had an average capacity utilization rate of 60 percent in 2023.

In 2024, Turkey’s steel industry has partly rebounded from a weak 2022-23 period, despite facing economic issues and competition for important markets. Crude steel output rose by 24 percent year on year to 12.5 million mt in the January-April period of 2024. The rise was a turnaround from a fall of four percent year on year in production last year to 33.7 million mt and a previous drop of 13 percent in 2022, with exports in 2023 down 29 percent year on year.

Turkey’s steel industry rebounds in 2024 after recent weak years

The increased production in Turkey became possible partly due to higher margins and partly due to increased consumption in the domestic market and increased sales to Europe.

Despite a difficult 2023 due to lower global steel demand, 2024 started off well for Turkish steel mills in the export segment. Turkish mills exported 1.27 million mt of flat products in the first quarter of 2024, which was almost double their exports in the first quarter of 2023 (0.7 million mt), according to the TUIK data. Long product exports were also up, increasing by 26 percent year on year to 1.86 million mt.

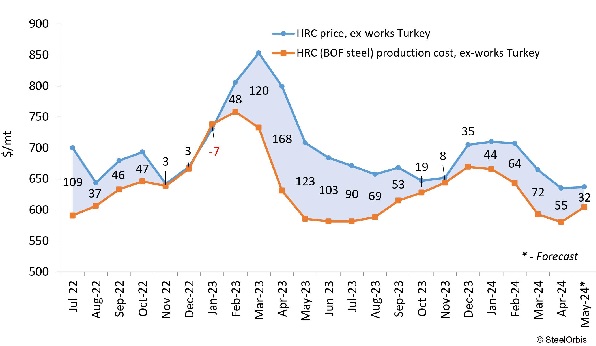

Due to the smaller drop in finished product prices compared to that in production costs during the first quarter of 2024, average finished product margins increased twofold or threefold, according to SteelOrbis’ data. Turkish HRC producers’ margins in their domestic market tripled on average, rising from $10-35/mt in the fourth quarter of 2023 to $45-70/mt in the first quarter of 2024.

Margins of Turkish BOF-based HRC producers in US dollars, ex-works basis

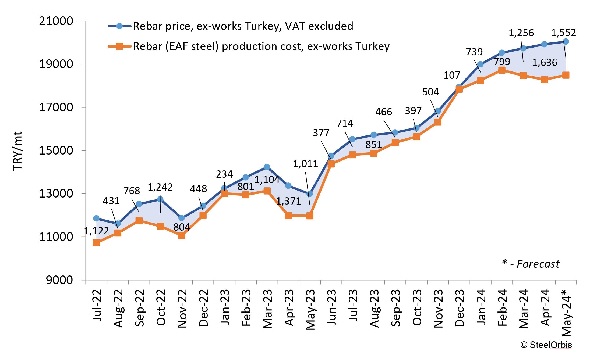

Higher Turkish lira-based raw material prices resulted in a steel production cost increase of TRY 1,800-1,900/mt to the levels of TRY 18,300-18,800/mt in the first quarter of 2024 for EAF-based rebar (in comparison with Q4 2023), but at the same time average rebar prices on ex-works basis increased by TRY 2,500/mt to TRY 19,000-19,800/mt (ex-works basis, VAT excluded). The higher rebar prices led to a tripling of domestic margins of Turkish EAF-steel rebar producers to TRY 900-1,000/mt quarter on quarter, according to SteelOrbis’ calculations.

Margins of Turkish EAF-based rebar producers in Turkish lira, ex-works basis

On the one hand, the structural transformation of Turkey's economy is proceeding in line with a new industrial policy. The Turkish government wants to channel resources to more productive areas, to reduce the country’s carbon footprint and to make the economy more competitive. To boost its position in Europe and potentially give it an advantage over its Asian rivals, the Turkish steel industry is moving towards lower carbon emissions.

Turkish steel producers are aiming to reach 14.5 million mt of steel exports this year, like in 2022, with the support of the recent rise in steel making capacities in Turkey and expected better demand in global markets as of the second half of the current year.

On the other hand, Turkey's steel industry is facing challenges due to high interest rates, the lack of clear prospects for demand growth in the domestic market and cheap steel products from Asian countries.

Turkey’s inflation accelerated to 70 percent annually in the month of April. The inflation rate marked the highest annual increase since November 2022, when inflation was around 85 percent. In 2023, the central bank raised its key interest rate almost fivefold, from 8.5 percent to 42.5 percent during the year, marking the country’s first hikes since March 2021. The rate hike and the hawkish tone were the strongest signals of a reversal after years of loose policy under President Erdogan, who prioritized growth and investments. In 2024, Turkey’s central bank has hiked its key interest rate to 50 percent, citing the continuing need to counter climbing inflation in the country. The tight monetary stance will be maintained until a significant and sustained decline in the underlying trend of monthly inflation is observed.

Also, Turkey's steel industry has to cope with cheap and subsidized imports from Asia mostly from China. According to the TUIK data, in 2023 finished product imports to Turkey rose by 12 percent year on year to 11.4 million mt. The poor performance of Turkey’s steel sector last year was caused by the actions of China, which have had a negative impact not only on Turkey but also globally.

In 2023, China exported 90 million mt, which contributed to the challenging export market situation faced by Turkish mills, with Turkish finished product exports dropping to just 10.3 million mt from 14.5 million mt in 2022, according to the TUIK data. SteelOrbis expects that Chinese steel exports will once again exceed 90 million mt in 2024, which Turkish mills fear could depress global demand for Turkish finished steel once again. In the first quarter of 2024, Chinese suppliers have already exported 25.8 million mt of steel, up 28 percent from the same period in 2023 when their exports totaled 20.1 million mt, according to Chinese customs export data.

The global market is also facing challenges due to high interest rates, limited credit insurance resulting from lower earnings and geopolitical challenges. Turkish mills are concerned about the risks faced by shipment of cargoes via the Red Sea, which have increased shipment times by 15-20 days, spiked insurance and freight costs, and have encouraged evolution of global trade chains. The negative situation in the Suez Canal and the Red Sea, due to the attacks by the Houthis in Yemen, has been putting shipments in the area at risk.

Industry participants expect steel demand to remain sluggish as long as the global costs of project financing remains elevated. Turkish steel producers are fully committed to complying with the EU’s green energy targets, but the industry need legislative and fiscal support from the Turkish government. This is especially important amid the conditions of the growth of new capacities in the Turkish market, in particular in the flat steel segment.