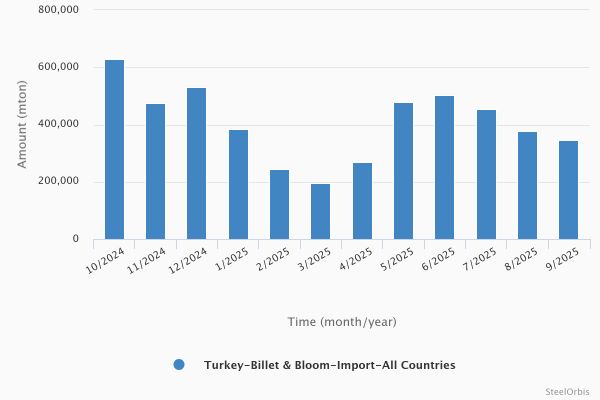

In September this year, Turkey’s billet and bloom imports amounted to 345,173 metric tons, down by 8.7 percent compared to August and up by 8.5 percent year on year, according to the preliminary data provided by the Turkish Statistical Institute (TUIK). Meanwhile, the revenue generated by these imports totaled $173.30 million, decreasing by 7.7 percent compared to the previous month and by one percent year on year.

In the January-September period, Turkey's billet and bloom imports amounted to 3.25 million mt, up 50.8 percent, while the value of these imports increased by 33.3 percent to $1.62 billion, both year on year.

Turkey’s billet and bloom imports - last 12 months

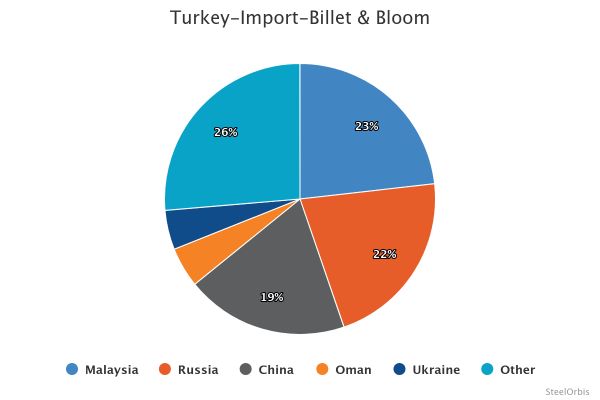

In the given period, Turkey’s largest billet and bloom import source was Malaysia, which supplied 753,469 mt, up 97 percent year on year. Malaysia was followed by Russia with 699,497 mt, up 56.1 percent, and China with 631,298 mt.

Turkey’s top 10 billet and bloom import sources in the January-September period:

| Country | Amount (mt) | |||||

| January-September 2025 | January-September 2024 | Y-o-y change (%) | September 2025 | September 2024 | Y-o-y change (%) | |

| Malaysia | 753,469 | 382,447 | 97.0 | 53,986 | 67,147 | -19.6 |

| Russia | 699,497 | 447,445 | 56.3 | 55,197 | 66,294 | -16.7 |

| China | 631,298 | 50,567 | >1000.0 | 109,960 | 50,387 | 118.2 |

| Oman | 155,421 | 29,684 | 423.6 | 28,969 | - | - |

| Ukraine | 153,114 | 140,222 | 9.2 | 9,888 | 31,709 | -68.8 |

| Vietnam | 127,007 | 43,854 | 189.6 | - | - | - |

| Algeria | 108,661 | 233,700 | -53.5 | 37,913 | - | - |

| Indonesia | 91,576 | 274,089 | -66.6 | - | 50,230 | - |

| Pakistan | 71,902 | 68,674 | 4.7 | 11,700 | 3,760 | 211.2 |

| Azerbaijan | 59,731 | 52,828 | 13.1 | 3,888 | 436 | 791.9 |

Shares in Turkey’s billet and bloom imports - January-September 2025