The Turkish government has forecast that Turkey’s economy will grow by 3.5 percent in 2024 year and by 4.0 percent in 2025. In 2023, the economy grew by an annual 5.1 percent and 6.5 percent in the third quarter of the year despite a slowdown in Turkey’s main trading partners and the fallout from the devastating earthquakes in southern Turkey in February 2023. In the third quarter of 2024, Turkey's economy grew at a less-than-expected 2.1 percent year on year as demand ebbed (especially in the services sector) under the weight of high interest rates. Third quarter GDP dipped by 0.2 percent from the previous quarter on a seasonally and calendar-adjusted basis, the Turkish Statistical Institute data showed, marking a second straight dip and a technical recession in Turkey. Economists expected tight monetary policies and fiscal measures to continue to slow domestic demand up to the end of the year.

The economy in Turkey, a major emerging market economy, has cooled in the face of the monetary tightening campaign that began in June 2023, with the Turkish central bank having hiked interest rates to 50 percent from 8.5 percent in order to rein in inflation, which exceeds 48 percent by the end of the year. Turkey's policy U-turn, ditching the previous low-rates policy championed by President Erdogan, is aimed at boosting exports, lowering inflation and rebalancing an overheating economy. Turkey's aggressive interest rate hikes cooled annual inflation to below 50 percent in October from above 75 percent in May.

At the same time, the Turkish steel industry is actively adapting to new conditions, despite the challenges in global markets and in the domestic economy. Turkey’s steel industry has been struggling with weaker competitiveness in the global markets, as the efficiency of the country’s production model has been under pressure from increased energy costs and financial problems during recent years.

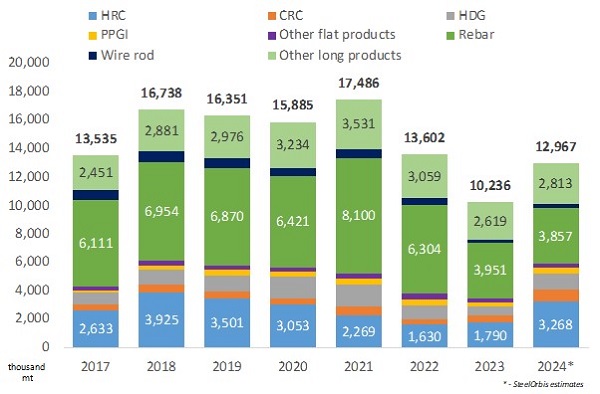

Regardless of the unstable economic situation in Turkey and the depreciation of the national currency, Turkey’s crude steel production in 2024 will rise by nine percent to 36.8 million mt, according to SteelOrbis’ estimations. In addition to increasing capacity by almost 1 million mt, furnace capacity utilization increased on average from 67-72 percent in 2023 to 70-80 percent in 2024. Finished steel product (longs and flats) production in Turkey in 2024 increased by 13 percent compared to the same period of 2023 to 42 million mt, while finished steel consumption remained stable at 38 million mt, according to SteelOrbis’ data. The growth in production was offset by exports. Turkey’s steel product exports rose to 13 million mt in 2024, from 10.2 million mt in 2023, according to SteelOrbis’ data, even despite lower margins. It should be noted that the export growth was observed principally in the flat steel market, with flat steel exports increasing by 70 percent year on year to almost 6 million mt in 2024. At the same time, long product exports only rose by four percent to 7 million mt. Unfortunately, these increases cannot be described as constituting fully-fledged growth, but were rather a recovery after the decreases in 2023, because export volumes did not even come close to the levels of 2022, not to mention 2018-2021.

Finished product exports from Turkey in 2017-2024

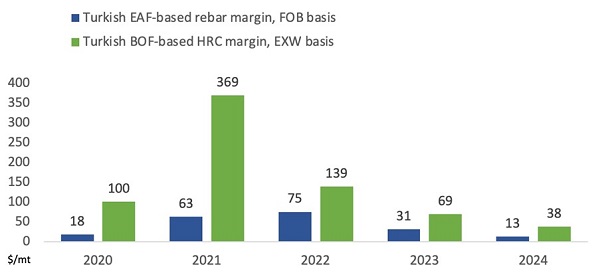

In 2024, prices were declining in the steel markets. In addition, prices of finished steel products during the year declined more than production costs, leading to a significant decrease in Turkish producers’ margins in a market that already lacked strength. In 2024, the production costs of Turkish EAF-based steel products decreased by an average of six percent, while the production costs of BOF-based steel products declined by an average of 11 percent, year on year.

According to the data for 2024, raw material prices decreased by a range of 2-15 percent. Thus, for the Turkish market, imported steel scrap became 2-4 percent cheaper, iron ore was 7-9 percent cheaper, while coking coal prices were lower by 10-15 percent. At the same time, domestic scrap prices increased significantly, by almost 40 percent, due to the weakening of the lira. The Turkish lira lost strength steadily against the US dollar during the year, sinking to a new record low, losing 36 percent in value year to year, falling to $1 = TRY 33.01 on average for 2024.

Average rebar prices on FOB basis in 2024 decreased by more than $45/mt to $585-595/mt on average, while the margins of Turkish EAF-based rebar producers decreased to $10-15/mt on FOB basis, from $30-35/mt in 2023, according to SteelOrbis’ data. Turkish HRC producers’ margins in their domestic market were halved during the year, falling from $60-75/mt in 2023 to $35-45/mt in 2024.

Margins for Turkey’s main steel products in US dollars

The price increases in the Turkish market were mostly seen in the first half of the year. In the second half of the year, the Turkish steel industry began to feel the impact of “the Chinese factor”. As of the August-September period, the Turkish market, like many other markets, began to suffer from an influx of cheap imported products from China. According to the data for 2024, Chinese steel product exports to Turkey will increase by a minimum of 30 percent year on year to 4.85 million mt, according to SteelOrbis’ estimations.

In 2024, an enduring credit crunch among Chinese property developers stifled the production of steel products and construction-related materials. China's property sector has been a significant drag on the country’s economy since 2021 when the Chinese government imposed tough measures to curb excessive leverage, which led to heavily indebted developers, stalled housing projects, and mortgage boycotts. Government policies to revitalize the market since 2023 have included lower borrowing costs and greater financing for struggling developers, but a meaningful recovery has yet to emerge despite these efforts. In September, China unveiled tax incentives for home and land deals to boost demand and alleviate the financial pressures on developers in a bid to revive the sector. However, Beijing is unlikely to target fresh rapid growth in construction activity, while there remains a massive overhang of unsold properties and would-be buyers remain wary of further potential falls in property prices. Instead, the Chinese government will likely aim to spur production among industries with large export markets, such as producers of electric vehicles, batteries and electronics. These industries are already motivated to increase sales over the near term to capture heightened consumer demand in Europe and North America ahead of Christmas and also before incoming US President Donald Trump raises fresh tariffs on imports.

Chinese steel producers, already exporting at near-decade-high volumes, are set to keep pushing out shipments in 2025 to manage overcapacity and soft domestic demand, which threatens to exacerbate mounting trade frictions. China’s steel product exports will hit a nine-year high in 2024 and may exceed 110 million mt. China's surging steel exports have sparked complaints from an increasing number of countries. Some, including Turkey and Indonesia, have imposed antidumping duties, arguing that the flood of cheap Chinese steel hurts their local producers.

In 2025, steel product demand in Turkey will remain at moderate levels, with no significant change expected. The level of construction activity, even if it improves, is still not expected to completely offset the challenging situation. The import segment will still be dominated by China. As for exports, Turkish mills will continue working in the ongoing challenging market conditions. Competition with North African suppliers in the longs segment will continue and Turkish mills will still be forced to compete with material produced at low cost since most Egyptian and both Algerian suppliers have DRI-based production. However, some factors may change the rules of the game. One issue is the expected announcement by the EU of the antidumping investigation results against imports of HRC from Egypt, India, Japan and Vietnam. In theory, this may help Turkish mills, which have been in a disadvantageous position in the European market for a while since they are subject to their own AD duty rates. Another issue, however, is that Tosyali Algerie has started commercial production of HRC at its 4 million mt plant and, although it is now focusing on trial lots to the domestic market in Algeria, the mill’s March production HRC may soon be offered to the export markets. Russia’s continuous presence in HRC exports in the region is also a threat to Turkish mills since specifically in the North African region Russia is very competitive price-wise and is able to sell large lots, particularly to Egypt.

The general expectations for Turkish steel market activity are largely pessimistic for the near future, with even harder market conditions possibly ahead for Turkish mills and causing some further output cuts. Geopolitical unrest is another issue since it influences many aspects of business, from economic and financial issues to difficulties in reaching regular customers - in Turkey’s case, customers in Israel, Yemen and now Syria and partially in Lebanon.