2024 was another year of slowdown and even recession in the European economies due to the reduction in stimulus measures and the long-standing tightening of monetary policy by the European Central Bank (ECB). These steps, nevertheless, had some positive impact on the economy, with the EU Harmonized Index of Consumer Prices (HICP) expected to decline from 6.4 percent in 2023 to 2.6 percent in 2024. The ECB, taking into account the gradual decline in inflation, has started to reduce the main interest rates, but the real impact of this measure will be felt no earlier than mid-2025. The real GDP growth rate in Europe’s largest economies is at its lowest level since the end of the coronavirus pandemic, and, although the ECB expects a small positive adjustment of the indicator from 0.4 percent in 2023 to 0.9 percent in 2024, a number of countries are experiencing a recession. Also, it should be noted that the gap between northern and southern Europe is widening. While Germany is close to a second year of recession, Italy is experiencing sluggish growth. Northern Europe’s heavy dependence on Russian energy supplies and the gradual recovery of tourism in southern Europe after the end of the pandemic contributed to this current situation. The differing stances of governments towards stimulating their own economies also played a significant role: while in Germany state programs were cut to a minimum, in Italy the government continued to invest in the economy.

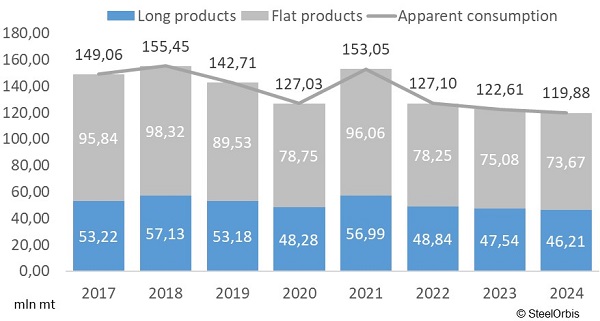

EU apparent finished steel consumption is expected to decline by at least two percent year on year to 120 million metric tons in 2024, according to SteelOrbis’ estimates, which is the lowest level since the 2008 financial crisis. Production of finished steel will decrease by three percent year on year, with steel exports and imports expected to grow by 1-2 percent and 3-4 percent year on year, respectively. In 2024, European steel producers were trying to increase export supplies as domestic consumption was at low levels. At the same time, the share of imports in EU finished steel consumption increased from 14 percent to 15 percent for long products and from 26 percent to 28 percent for flat products, year on year. In October, the European Commission announced the start of the registration process for HRC imports from Egypt, India, Japan and Vietnam, which are subject to ongoing antidumping investigations. The registration of imports, which will expire within nine months, will enable the retroactive collection of antidumping duties if necessary.

EU finished steel product consumption

Steel companies in northern Europe are selling off subsidiaries and restructuring their product ranges, focusing on high-tech steel grade production instead of tool steel and engineering steel production, in response to the consumption crisis. Meanwhile, in southern Europe, measures such as output cuts, stoppages for long holidays and lay-offs of employees are still allowing companies to stay afloat. The respective situations in the long and flat steel markets in Europe differ only slightly. Neither of the markets has a solid basis for growth. Consumers of long products are in no hurry to invest in construction due to the economic turbulence in the EU. The EU flat products market, dependent on the automotive industry, is faced with competitive products from Chinese suppliers. China’s steel exports in 2024 will likely surpass the 2015 record of 110 million metric tons, reaching more than 111 million metric tons. Cheap Chinese steel is flooding the global market, creating challenges for local producers who are no longer able to raise their prices.

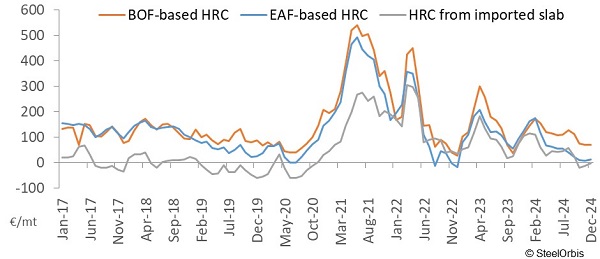

The margins of integrated flat steel producers in Europe at the end of 2024 were only a quarter, or at best a half, of their margins at the start of the year - €40-70/mt against €130-170/mt. The profitability of EAF-based flat steel producers was gradually approaching negative values, being just €5-20/mt at the end of 2024. At the same time, EU-based re-rollers of imported slabs, even ex-Russia slabs, which are sold at discounts, were not making any profits in the last months of 2024. Although the margins at the end of 2024 corresponded to those at the end of 2019, it should be noted that the total change in the HICP in the EU was more than 20 percent in the 2019-2024 period and that the euro indicated a four percent depreciation against the US dollar in 2024 as compared to 2019.

Margins of European HRC producers in euros, on ex-works basis

The European Steel Association (EUROFER) and the industriAll trade union have called on the European Commission to hold a European Steel Summit in early 2025 to discuss the EU Steel Action Plan, which proposes steps to restore the competitiveness of the regional steel industry. The key points of the plan are to strengthen the EU’s trade protection, introduce measures to ensure that the CBAM works in practice, to secure access to critical raw materials for steelmaking, including steel scrap, to adopt measures that transfer cost-efficient electricity to consumers, and to increase support for investment in the transition to green steel.

The situation in the European steel markets may worsen in 2025 amid new external challenges such as trade flow segmentation and the escalation of trade wars. US President-elect Donald Trump has repeatedly stated his intention to raise duties on imported products from China, Europe, Canada and Mexico, which could happen as soon as January 2025. Redirection of trade flows from the US market towards Europe may put even more pressure on prices in the EU. In addition, in 2024 the share held by the US in the EU’s exports amounted to 5-10 percent for HRC and 10-20 percent for rebar and wire rod.

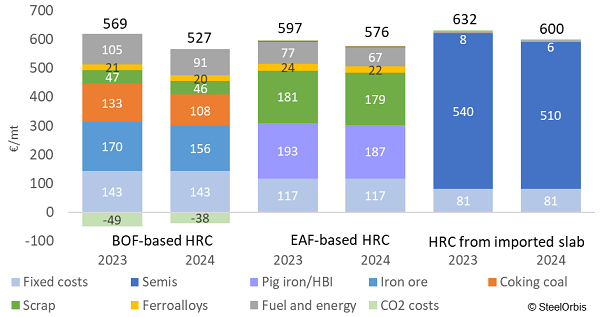

European steelmakers are caught between the inability to increase finished steel prices on the one hand and the inability to reduce production costs on the other. In 2024, HRC prices in Europe fell by 11 percent year on year. The pace of cost reduction was much slower. BOF-based HRC producers in Europe achieved only a seven percent reduction in costs during the year. Integrated Chinese HRC producers had a similar decline in costs, as global iron ore and coking coal prices are formed in Asia. A real bottleneck for European steelmakers turned out to be the prices of steel scrap and electricity. In 2024, EAF-based HRC producers and re-rollers of imported slabs in Europe were able to reduce their costs by no more than three percent and five percent year on year, respectively.

Italian HRC full cost structure, ex-works basis

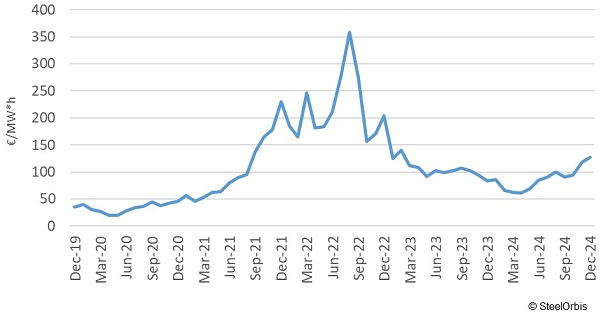

Large BOF-based European steel producers are postponing or abandoning decarbonization projects due to a lack of demand for green steel in the domestic market and insufficient government support. EAF-based steel remains at a disadvantage since European governments do not have a structured approach to providing the industry with affordable energy. Each country in Europe is trying to solve the problem of rising electricity prices on its own. For example, Italy and France are considering joint investments in nuclear energy, while Germany is targeting the development of renewable energy sources. Green hydrogen projects are also being scrapped due to economic unprofitability and a lack of clarity regarding market regulations. In December, electricity prices were over €120/MWh in major European markets, almost double year on year.

Average electricity price in major European countries

In 2025, apparent steel consumption in Europe may recover slightly, but even maintaining the previous level of consumption will be quite a challenge. Costs and profitability of finished steel products in Europe may increase slightly in parallel with the strengthening of demand. The easing of monetary policy and the possible adoption of a structural plan for the industry’s recovery by the European Commission are the only possible factors that may support growth.

The EC will primarily strengthen safeguard measures against imports, which can be implemented quickly and bring results almost immediately, albeit for the short term. The European steel market will become more closed, which is expected given the similar policy in the US and the aggressive strategy of extensive development in China.

The European steel sector will probably persuade governments to subsidize the energy sector, which will not resolve the accumulated problems, but only worsen them. The development of renewable energy sources is the best solution, but it also requires financial investment. The recognition of steel scrap as a strategic secondary raw material and resulting export restrictions may reduce the cost of scrap in the short term, but in the long term it will only lead to a reduction in scrap collection.

If the EC approves a structural plan for the green steel and energy market and allocates sufficient funds for their development, demand for steel products will recover, but the real effect of these measures will only be felt over time. Other short-term measures may provide support in difficult times, but should be replaced by more fundamental decisions.