The long-delayed Simandou iron ore project in Guinea, now entering production, is poised to reshape the balance of power in the global iron ore market.

Backed by major Chinese stakeholders, the $23 billion venture represents the world’s largest untapped iron ore deposit, estimated to contain at least 3 billion metric tons of high-grade ore. As operations begin, Simandou is expected to transform Guinea’s economy and significantly enhance China’s control over global commodity pricing, according to a report by Bloomberg.

Scale and strategic significance

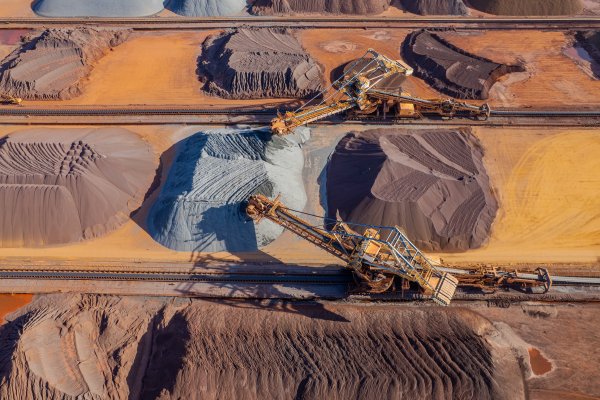

The operation encompasses two major mining blocks, jointly developed by Rio Tinto and Aluminum Corporation of China (Chinalco) on one side, and Winning Consortium Simandou (WCS) - a coalition of Chinese and Singaporean firms - on the other.

Rio Tinto, which will take another year to complete its mine and port, plans to ramp up output to 60 million tons a year over 30 months, while WCS has not disclosed its timeline to reach the same level. Together, the two groups will produce up to 120 million mt of iron ore annually, equivalent to around five percent of global output once full capacity is achieved.

The iron content of Simandou’s ore exceeds 65 percent Fe, making it among the highest-grade resources globally and highly desirable for low-emission steelmaking. The first shipments are expected to begin by the end of this year, with ramp-up phases extending through 2028.

China’s expanding influence in global iron ore

Simandou consolidates China’s long-term strategy to reduce dependency on Australian and Brazilian mining giants such as BHP Group, Vale, and Rio Tinto itself. The project’s completion grants Beijing a level of pricing influence never before seen in the seaborne iron ore trade. By securing domestic access to a high-grade and reliable ore supply, China’s state-run entities like China Mineral Resources Group (CMRG) and China Baowu Steel Group - now the world’s largest steelmaker - are expected to gain a decisive cost advantage.

Economic impact on Guinea

For Guinea, Simandou represents a once-in-a-generation economic transformation. Government projections indicate that the mine will increase GDP by over 25 percent by 2030. Under current agreements, the Guinean state holds a 15 percent free-carry stake in each mining consortium, ensuring direct fiscal benefits.

Beyond mining, the project’s associated infrastructure - including 300 bridges, a deep-water port, and over 140 locomotives ordered from the US - will integrate remote regions into the national economy. The government has pledged to reinvest revenues into diversifying the economy through its Simandou 2040 development roadmap, focusing on sectors such as energy, logistics and education.