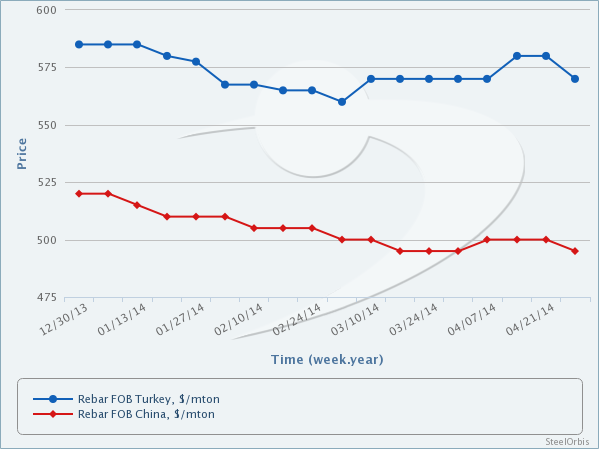

According to market sources, Turkey's rebar export offers have seen a decline of $10/mt as compared to last week, with the new prices standing in the range of $565-575/mt FOB on actual weight basis. The downtrend of scrap prices has strengthened global buyers' expectations for lower finished steel prices from Turkey and these expectations have been reflected in this week's Turkish rebar export offers. In the meantime, even though no significant demand improvement is anticipated for import rebar in the Middle East and North Africa in the short term, Turkish rebar deals will likely be concluded at $560-570/mt FOB on actual weight basis in the coming days. Meanwhile, aggressive ex-China rebar offers at $495/mt FOB are making it difficult for Turkish producers to keep their prices firm in these markets.

Demand for Turkish rebar recorded a recovery in the UAE market in the past two weeks and some deals were concluded at $580-592/mt CFR ($572-585/mt FOB) for about 90,000 mt of rebar in total. Import rebar demand in Egypt and Iraq, on the other hand, has remained on the weak side. However, after the parliamentary elections in Iraq held on April 30, demand for import rebar in the country is expected to gain strength and bookings from Turkey's Iskenderun region are expected to be concluded at $580-590/mt ex-works.

Weekly price movements of different steel products in major markets can be viewed comparatively in the SteelOrbis Historical Steel Prices section. Market trends can thus be seen more clearly, while desired charts can be created and used in reports or presentations.