After a healthy couple months of energy pipe imports earlier this summer, activity levels have slowed since early July; as offshore prices dropped, so did buyers' confidence. However, rising flat rolled coil costs have temporarily put an end to slumping foreign prices, leading to an increase of quoting activity from some of the larger offshore pipe buyers.

Oil country tubular goods (OCTG) demand has demonstrated the most strength during the summer lull, and is now generating more quoting activity over other pipe products. A testament to this is that rig counts have continued to grow, although according to Baker Hughes, active US rigs actually decreased by three for the week ending September 3, marking the first week-over-week decrease since the end of May. Nevertheless, this last week is expected to be just a minor blip on the radar. Current rig counts are still up 48 from four weeks ago and up 433 from the first week of the year. Currently, buyers are not blowing up the phone lines and emails of offshore suppliers, but there is an upward trend at least in terms of quoting and buying confidence. Whether this will translate into bookings--for very late 2010 or very early 2011--remains to be seen.

The most competitive offerings of API J55 electric resistance welded (ERW) OCTG casing are currently being found from Asia, with Korea and Taiwan leading the way. The average range of these offers is from $48.50 cwt. to $49.50 cwt. ($1,069/mt to $1,091/mt or $970/nt to $990/nt) duty-paid, FOB loaded truck in US Gulf ports. While Taiwanese offers had been slightly higher than Korean offers in recent weeks, Taiwanese mills are now said to be more aggressive, thus leveling the playing field.

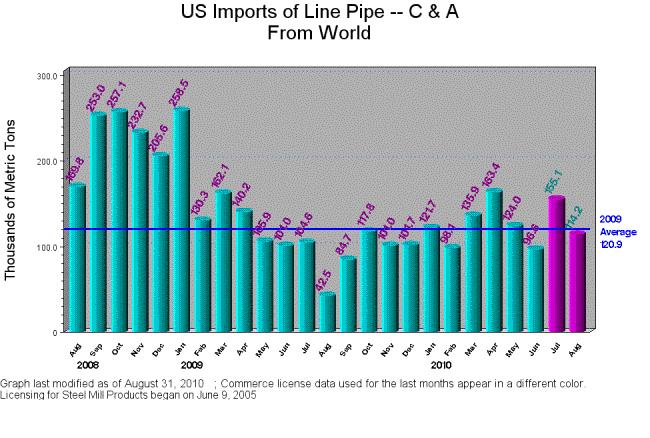

Import offers on API X42 ERW line pipe are most competitively offered from Taiwan, at approximately $45.50 cwt. to $46.50 cwt. ($1,003/mt to $1,025/mt or $910/nt to $930/nt) duty-paid, FOB loaded truck in US Gulf ports. Traders have seen some Korean offers; however, Taiwanese offers are the primary ones being entertained for the time being. An interesting note is that according to the US department of commerce, after a spike in line pipe tonnage arriving from offshore sources in July, at 155,454 mt (preliminary census data), license data collected through the month of August suggest that tonnage arriving in August will be significantly less, at 114,215 mt.