With the slippage in pricing for US domestic HRC and the $30-$40/lt reduction in scrap, the most recent price increase announcement for US domestic hollow structural section (HSS), which touted “increased production cost” has come and gone.

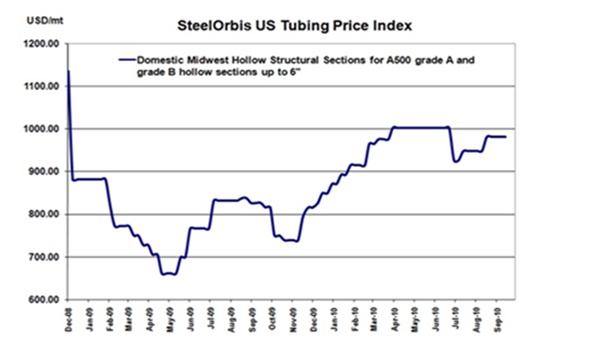

Although mills had been hoping to garner a $1.50 cwt. ($33/mt or $30/nt) bump in transaction pricing, HSS spot offers have remained neutral from our last report two weeks ago and are still being reported at approximately $44.00-$45.00 cwt. ($970-$992/mt or $880-$900/nt) ex-Midwest, and $48.00-$49.00 cwt. ($1,058-$1,080/mt or $960-$980/nt), ex-West Coast.

“That increase has left the building with Elvis,” said one buyer in the South. “All the feedback was negative, transaction pricing hasn’t moved, and the mills just haven’t been able to get it up.”

And while it’s been reported that a couple of mills have already rescinded, no one has yet to put it in writing.

Service centers throughout the country have pointed all eyes on hot rolled coils, with a growing concern that downticks seen within that market may soon begin to spill over into their own. The wild card in the equation seems to be Thyssen Krupp- who is making a national play to sell product. If they begin to get aggressive with HRC offers, say some, the “whole house of cards could come tumbling down”.

While some are forecasting a $1.00-$1.50 cwt. ($22- $33/mt or $20-$30/nt) decline in currently seen spot offers for HSS by the close of the fourth quarter before shifting back up in 2011, others are reporting concerns that if HRC ticks down below $26.00 cwt. ($573/mt or $520/nt), that prices could dip even little lower.

For now though, the forecast for HSS will remain neutral to slightly downward, with inconsistent business, a weak economy and a decreasing cost of production anticipated to start making an impact to HSS pricing as the month moves forward.

Looking offshore, import offers continue to remain silent. Although there have been some rumors of Turkish offerings, buyers are indicating that until more stability is seen within the domestic market, interest will be light at best.