Mirroring the recent drops in US domestic flat-rolled prices, domestic hollow structural sections (HSS) market prices are falling under pressure.

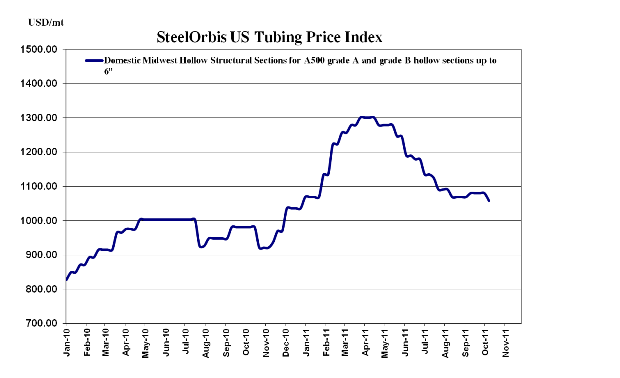

As expected, the approximately $1.00 cwt. ($22/mt or $20/nt) drop in US domestic flat-rolled spot prices over the last two weeks has forced a decline in US domestic HSS spot prices. Sources tell SteelOrbis that tubing mills have been quietly reducing asking prices by about $1.00 cwt. in the last two weeks to approximately $48.00-$49.00 cwt. ($1,058-$1,080/mt or $960-$980/nt) ex-Midwest mill, but spot prices have already fallen below that level. Current domestic HSS spot prices have dropped into the range of about $47.00-$49.00 cwt. ($1,036-$1,080/mt or $940-$980/nt) ex-Midwest mill, down $1.00 cwt. since late September. But because of continued lethargic demand levels, mills have been quick to cut deals on orders of substantial size.

In terms of end-use demand, with the exception of a "few small construction jobs out there, there isn't much going on," according to one distributor in the Southeast, and steady energy-related, OEM, and agriculture activity isn't enough to keep domestic HSS prices afloat. As a result, the HSS market is likely to continue to follow movements in the flat-rolled market until year-end. And unfortunately for the HSS market, flat-rolled prices have only begun to soften, as a lack of activity compounded by increased availability is pushing spot prices lower.

While the domestic HSS prices are dropping, import prices are unlikely to fall. Turkish HSS offer prices to the US fell a slight $0.25 cwt. ($5.50/mt or $5.00/nt) in the last two weeks to $44.75-$45.75 cwt. ($987-$1,009/mt or $895-$915/nt) DDP loaded truck in US Gulf ports, but trader sources have told SteelOrbis that the current offers are "unworkable"; however, further drops are rather unlikely due to a strong Turkish domestic market. Either way, buyers in the US are not interested, and likely won't be until domestic prices demonstrate some sort of stability for more than just a week or two.