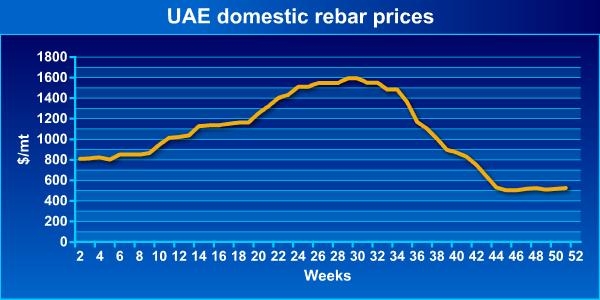

Due to the global crisis which has been exerting a negative impact across the international markets, the Middle Eastern rebar market experienced greatly contrasting trends in the two halves of 2008. In the context of the current pessimistic outlook, UAE rebar mills, which have been reviewing their domestic projects for 2009, have led traders and mills operating in this region to revise their trading volume plans for next year.

This week, the price levels of rebars have stood in the range of TRY 770-800/mt ex-works/ex-warehouse, including VAT ($432-449/mt excluding VAT) in the Turkish domestic market. Against the background of high scrap prices seen in this market where traders have low stock levels, domestic traders and mills do not expect a reduction in finished steel prices. Turkish mills have this week determined their rebar export offers in the range of $470-490/mt FOB Turkey and they have concluded important bookings to Portugal, Iraq and Algeria. It is heard that bookings concluded to Portugal have been at the levels of $465-470/mt FOB Turkey.

Moving to the UAE domestic rebar market, offers for cash payments have this week been standing at the level of AED 1,800/mt ($490/mt), whereas offers for deferred payment have been at AED 1,900/mt ($517/mt). It is observed that end-users have gained confidence in the domestic market with prices remaining unchanged for the last seven weeks, while demand has been trending in the same way. Meanwhile, offers given by Turkish mills to the region in question have been in the range of $460-470/mt CFR Dubai. However, it is seen that domestic traders have tried to lower these offers.

As for the Saudi Arabian domestic rebar market, price levels have continued their stable trend over the last month. Local offers for 8 mm rebar in the Saudi Arabian market have been at the price level of SAR 2,130/mt ($569/mt), offers for 12 mm have been at SAR 1,930/mt ($515/mt), while 16 mm and above have been offered at SAR 1,870/mt ($499/mt). It is seen that inventories in the local market are still at considerably high levels, while demand from end-users is not very strong.

Prices in the local Yemeni rebar market have been moving on a downtrend. The prices here, which are at high levels as compared to the UAE and Saudi Arabian domestic rebar markets, have been gradually approaching the levels of these countries. Import rebar prices in the domestic market of Yemen have this week been at the level of YER 108,000-110,000/mt ($540-550/mt) ex-warehouse, excluding VAT, on theoretical weight basis and for cash payment, while local production rebar prices have this week been in the range of YER 100,000/mt ($500/mt) ex-works, excluding VAT, also on theoretical weight basis and for cash payment.