Whether shredded scrap pricing moves sideways or slightly down, there is a strong indication that US domestic wire rod mills will keep prices level.

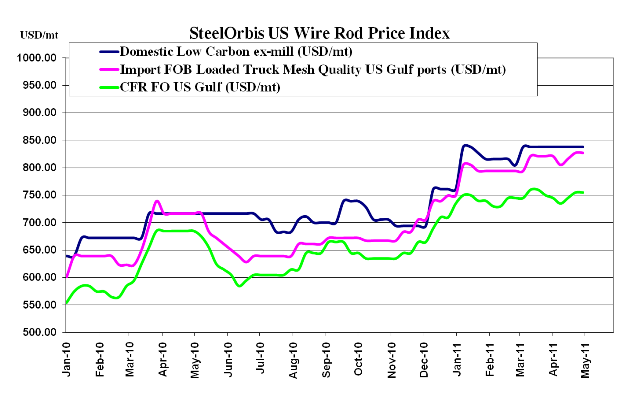

Spot prices for US domestic wire rod have not changed in the last week, bolstered by unattractively high import offers and steady, moderate end-use demand levels. The current spot range is still $37.50-$38.50 cwt. ($827-$849/mt or $750-$770/nt) ex-Midwest mill, and sources tell SteelOrbis that even if shredded scrap pricing drops by $20/lt as some predict, mills will not necessarily need to drop wire rod offers as well.

This sentiment was apparent at the American Wire Producers Association (AWPA) Wire Rod Supply Chain Conference earlier this week in Atlanta, Georgia. Speakers and attendees alike expressed a cautiously optimistic outlook for domestic wire rod in both the short-term (through the end of Q2) and long-term (through the end of 2011). Domestic wire rod mills are not expected to raise production levels much this year, while further down the supply chain, wire product producers and distributors are currently keeping inventory levels in check. The past four months of relative price stability in the wire rod market has been embraced by many, but most do not expect it to last.

Additionally, high import offers of wire rod to the US are also not expected to last, as it becomes increasingly apparent that a mere $0.50 cwt. ($11/mt or $10/nt) spread between import offers and US domestic wire rod prices is not alluring enough to book future shipments. After rising last week, Turkish wire rod prices in the US have remained the same this week, still ranging from $37.00-$38.00 cwt. ($816-$838/mt or $740-$760/nt) duty paid FOB loaded truck in US Gulf ports. However, the local Turkish wire rod market is trending up, so import offers to the US could potentially increase in the next week.