Although this month's price increase announcement for wire rod is expected to be in the ballpark of $30/nt, domestic mills' lips are sealed for the moment.

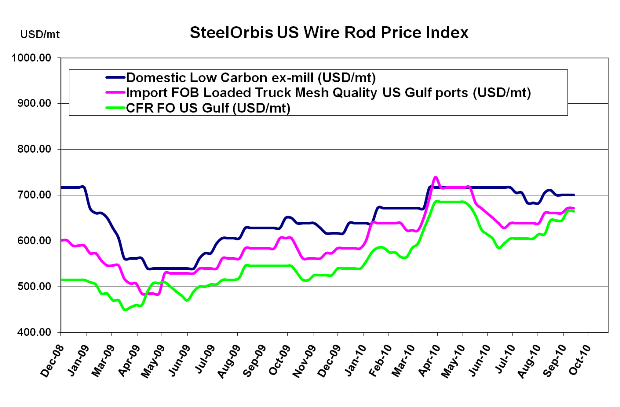

It has been a week since the official scrap announcement heralded a $28/long ton increase for shredded scrap, but US mills are biding their time before making any decision about how the scrap hike will translate into transaction prices. Rumors that prices could go up by $1.50 cwt. ($33/mt or $30/nt) are now running rampant throughout the market, even though an increase of that level would be more than the scrap increase ($28/lt equals $1.25 cwt. or $25/nt). However, the consensus is that even if mills have the audacity to raise prices beyond their new raw material costs in such a weak environment of demand, the increases will not stick and mills will end up absorbing much of the latest scrap hike. Currently, official asking prices are still in the range of $31.50-$32.50 cwt. ($683-$717/mt or $630-$650/nt) ex-mill, and buyers are getting anxious to know what the mills will decide for October pricing.

While domestic mills could become flexible with pricing by force, Mexican mills are expected to willingly shape their prices based on what the market demands. Last week, Mexican mills announced that prices would indeed increase on a case-by-case basis, and prices have been heard at $1.00-$1.25 cwt. ($22-$28/mt or $20-$25/nt) higher than before, putting prices above $30.00 cwt. ($661/mt or $600/nt) as predicted last week. Although this move brings prices on par with wire rod from overseas, Mexican mills offer smaller shipments, and if the tide turns against US mills, Mexican wire rod producers will likely drop prices to meet demand.

As for Turkish wire rod, prices have not changed since last week, still unattractively high at $30.00-$31.00 cwt. ($661-$683/mt or $600-$620/nt) duty paid, FOB loaded truck in US Gulf ports. The market in Turkey has sparked with activity recently with the end of the Ramadan holiday, and with scrap prices still firm overseas, the trend for Turkish wire rod is definitely up. But most buyers in the US, who don't see the advantage of buying for fourth-quarter deliveries, are expected to stick with domestic or Mexican wire rod for the time being.