As US rebar mills push for the full scrap increase, base prices see some unexpected adjustment.

In the beginning of this month, it was no secret that domestic mills were expecting another significant boost in scrap pricing, and customers braced for the reality that rebar prices for February shipments would jump up by an equal amount. It was a mild surprise then, when mills announced an immediate $2.00 cwt. ($44/mt or $40/nt) base price increase on January 3. The raw material surcharge (RMS) announcement was not far ahead, leading customers to wonder what the rush was. As price speculation for scrap continued to move upward, many rebar customers assumed that mills would slap the entire scrap increase on top of the immediate base increase--but, oddly, they didn't.

After January shredded scrap prices were announced at a $65/lt increase, rebar mills responded with the expected $3.25 cwt. ($72/mt or $65/nt) increase in the RMS. However, mills decreased the base price by $1.00 cwt. ($22/mt or $20/nt), which brought the total transaction price increase (for February shipments, including the January 3 base increase) to $4.25 cwt. ($94/mt or $85/nt). So, why did mills increase base prices immediately, only to lower them for February shipments? Was it a shrewd marketing tactic, or has confidence in the near-future market waned? Unfortunately, those are not the types of questions that mills answer freely, so many customers have been left scratching their heads about the latest announcement.

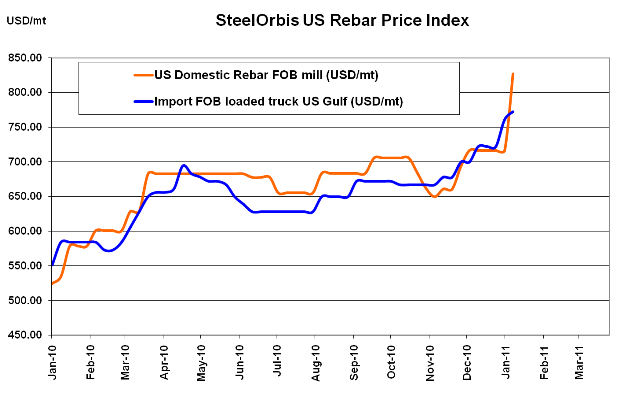

Nevertheless, spot prices for rebar have firmed up in the last week, and most transactions are now being concluded at $37.00-$38.00 cwt. ($816-$838/mt or $740-$760/nt) ex-mill, reflecting a $3.00 cwt. ($66/mt or $60/nt) increase from a week ago--an amount, it should be noted, that is above the recent immediate base increase. Current asking prices, on the other hand, are heard to be in the range of $40.00-$41.00 cwt. ($882-$904/mt or $800-$820/nt) ex-mill, and it remains to be seen if the mills will get the rest of the increase in February.

Overseas mills have raised their offers as well, but prices have not increased in the last week as dramatically as US prices have. Turkish rebar prices in the US are now in the range of $34.50-$35.50 cwt. ($761-$783/mt or $690-$710/nt) duty paid FOB loaded truck in US Gulf ports, reflecting a $1.50 cwt. ($33/mt or $30/nt) increase from a week ago. US-based traders are still reporting inquiry activity for imported rebar, based in large part on speculation that scrap will continue to move upward in February.

Mexican rebar mills are also following the US market closely, nearly mirroring US increases. Official asking prices are heard to be in the range of $38.00-$39.00 cwt. ($838-$860/mt or $760-$780/nt) duty paid FOB delivered to US border states, with actual spot prices closer to $36.00 cwt. ($794/mt or $720/nt)--a difference of approximately $3.00 cwt. from previously-reported spot prices.