After an immediate base price increase that took many by surprise, rebar buyers in the US are preparing for a raw materials surcharge hike within the next week.

Current predictions now point to a shredded scrap increase of around $55-$65/long ton, and rebar mills are expected to raise the raw materials surcharge (RMS) by just as much. Including the late-Tuesday announcement by Nucor of an immediate $2.00 cwt. ($44/mt or $40/nt) price increase (other mills are sure to follow), that would lift prices by an approximate total of $5.00 cwt. ($110/mt or $100/nt) for February.

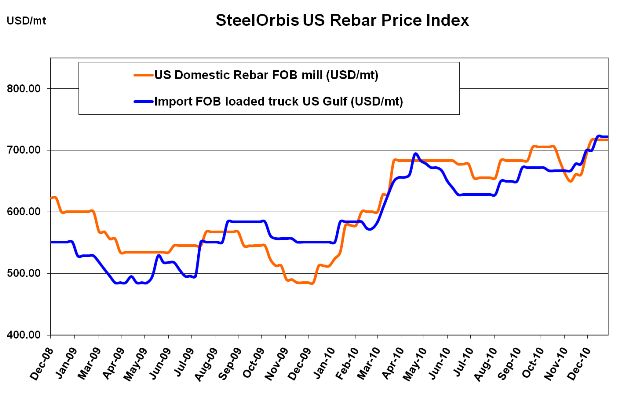

With the next price increase imminent, mills are expected to stand firm with the immediate $2.00 cwt. bump, which would lift spot prices into the range of $34.00-$35.00 cwt. ($750-$772/mt or $680-$700/nt) ex-mill. Before the announcement was made, SteelOrbis had learned that imports were coming in and being sold around $32.00 cwt. ($705/mt or $640/nt) duty paid FOB loaded truck in US Gulf ports from Turkey, and domestic mills were trying to match prices for their largest customers. However, most deals--even the so-called "foreign fighter" discounts--have now virtually dried up; mills seem to be bullish on scrap pricing for the next couple months, and they see no reason not to push through their own price increases.

Aside from lower-priced product currently arriving in ports, import inquiries had quieted down in the last week. However, now that rebar prices in the US are predicted to rise even through March, many rebar buyers are once again checking in to offers from overseas. Due to scrap price increases in Turkey, Turkish rebar mills have also raised import offers to the US, but more cautiously-by only $0.75 cwt. ($17/mt or $15/nt) in the last week. Most offers are now between $33.00-$34.00 cwt. ($728-$750/mt or $660-$680/nt) duty paid FOB loaded truck in US Gulf ports, with most transaction leaning toward the higher end of the range.

Mexican mills, which have been pegging their price increases to US movements, have not yet announced any change. But if Mexican mills mirror the US increases by the full $5.00 cwt. for February, that would put Mexican offers over $37.00 cwt. ($816/mt or $740/nt) duty paid FOB delivered to US border states at the beginning of next month.