After weeks of hesitant purchasing activity and soft spot pricing, domestic rebar has resurged as of the first of the month.

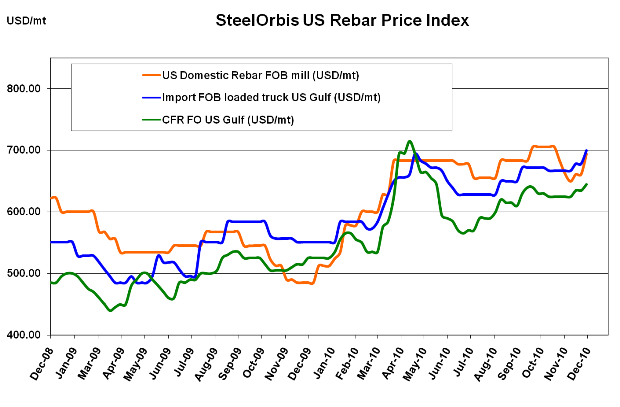

Sources have told SteelOrbis that even though the month just began, activity is already "normal to brisk for December," and because mill inventories were relatively low, they have been able to push for higher prices now that the $1.00 cwt. ($22/mt or $20/nt) increase announced in mid-November has taken effect. While this does not exactly mean that mills are getting their asking prices--including the extra $1.00 cwt., that would bring them to $31.75-$32.25 cwt. ($700-$711/mt or $635-$645/nt) ex-mill--it does mean that spot prices have gone up, with most transactions now concluding at around $31.50 cwt. ($694/mt or $630/nt) ex-mill, compared to last week's spots of $29.50-$30.50 cwt. ($650-$672/mt or $590-$610/nt) ex-mill.

This trend reversal is mostly based on the strong likelihood that scrap pricing will maintain its upward momentum throughout the remainder of winter, with expectations of a $30/long ton shredded scrap increase this month. Domestic rebar mills have already implied that they will raise transaction pricing again for January shipments, and with end-use activity not entirely terrible, rebar buyers have an incentive to place orders before prices go up again.

Speaking of demand, economic indicators point to a much better fourth quarter than many predicted. Already, construction spending is up in the US-according to the US Census Bureau, the seasonally adjusted annual rate increased 0.7 percent in October from the previous month. While residential construction is still relatively lackluster, major infrastructural projects are moving the construction industry forward. For example, the Washington State Department of Transportation recently awarded a $306 million contract to reconstruct State Route 520, a project that will involve widening and redeveloping the highway and constructing three new bridges over it. Construction will begin in the spring of 2011 and should be completed by early 2014.

If construction's upward momentum continues, and a measure of confidence is restored in the rebar market, there's a good chance rebar buyers will take the gamble with imports-even if they don't come out on top in terms of pricing, healthy rebar demand will at least ensure that they'll be able to turn around inventory. For now, import offers from Turkey are just slightly below US domestic prices, after increasing by $1.00 cwt. in the last week. Turkish prices are now in the range of $31.25 to $32.25 cwt. ($689-$711/mt or $625-$645/nt) duty paid FOB loaded truck in US Gulf ports, and while there are not that many takers at this price, the situation could change if US prices maintain their upward trend.

South of the border, Mexican offers are expected to elevate soon in response to US prices, but for now, prices are still in the range of $28.75-$29.75 cwt. ($634-$656/mt or $575-$595/nt) duty paid FOB delivered to US border states, with most transaction concluded at the high end of the range.