Construction projects in Turkey have accelerated this week in line with improved weather conditions. In addition, a likely revival in agricultural sector is foreseen to have a positive impact on wire demand.

Due to wire rod producers' ongoing management problems and maintenance works, wire rod buyers in Turkey's Marmara region have been still facing supply problems. Although these buyers are seeking to compensate their short supplies by wire rod purchases from other regions of the country, they are now forced to reflect the increased costs arising from delivery rates in their own sales prices. While the shipments of previously concluded import transactions have continued this week, considering lead times and freight costs, wire rod offers given by European and CIS producers to the Turkish market were unable to attract much interest.

As regards final product (steel mesh, nail, wire) sales, the Iranian market has continued to be one of Turkey's key markets. SteelOrbis has learned that Turkish mills, which have been testing $700/mt FOB and slightly above price levels for mesh quality wire rod for a while, have moved up their export offers this week to the price range of $705-715/mt FOB for late April and May shipments. In the meantime, buyers in Dubai are seen to show interest to wire rod offers at $700/mt CFR.

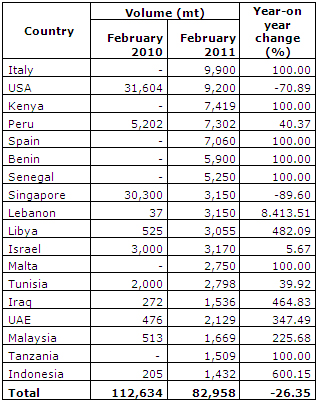

According to the data provided by the Istanbul Mineral and Metals Exporters' Association (IMMIB), as can be seen below, in February this year Turkish wire rod exporters have tried to compensate the absence of the Middle Eastern and North African markets by supplying wire rod to other regions of Africa, as well as to Europe. Thus, Turkish wire rod sales to Kenya and Tanzania from East Africa in February can be interpreted in this context.

As SteelOrbis has previously reported, in February this year Turkish wire rod sales to the Italian market had reached a significant volume. And as we have already moved into mid-March, Italian wire rod buyers are expected to return to market for new bookings after the national holiday that ends tomorrow, March 18.

On the other hand, Turkey's wire rod exports to the US, a major export market for Turkish wire rod mills, showed a clear drop in February. Nevertheless, following wire rod price hike announced this week in the US domestic market, Turkish mills are again predicted to head to the US market. In the meantime, the decline in Turkey's wire rod sales to Singapore in February is significant.