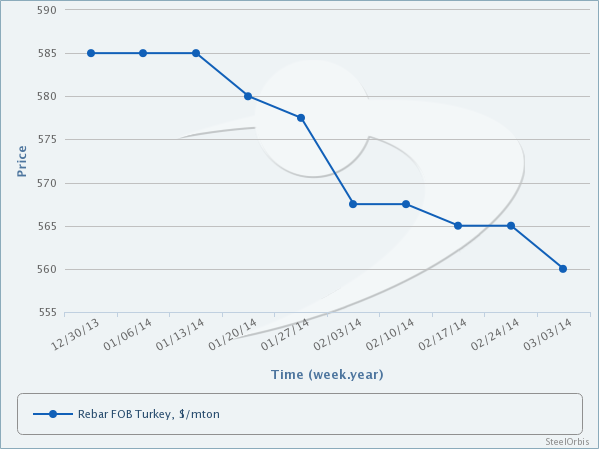

According to market insiders, Turkey's rebar export offers have softened by $5/mt on the high end over the past week to $555-565/mt FOB on actual weight basis. Activity for Turkish rebar on the export side has indicated improvement over the past week, while some ex-Turkey rebar deals have been concluded in the Middle East and North Africa. Accordingly, an ex-Turkey booking for about 10,000-15,000 mt of rebar has been concluded in Yemen at $575/mt CFR ($555/mt FOB) on theoretical weight basis, whereas deals from Turkey's Iskenderun region to Egypt for approximately 30,000 mt of rebar in total have been concluded at $573-575/mt CFR ($560/mt FOB) on actual weight basis. In the meantime, March shipment sales for ex-Turkey rebar have been completed in the UAE market at $565-570/mt CFR on theoretical weight basis.

Ex-Turkey rebar sales have improved in the past week, showing that current offers gain acceptance by foreign buyers. Although import scrap prices have weakened by $50/mt since January, Turkish finished steel offers have only declined by $25/mt over the same period. In the meantime, due to the current political tension in Turkey, buyers on the export side are relatively cautious as regards concluding deals from Turkey. If import scrap prices in Turkey continue to trend at $348-355/mt CFR, no significant revisions are expected in finished steel prices. Sources also state that actual buyers on the export side may conclude bookings at the $550/mt FOB mark.

Weekly price movements of different steel products in major markets can be viewed comparatively in the SteelOrbis Historical Steel Prices section. Market trends can thus be seen more clearly, while desired charts can be created and used in reports or presentations.