Although domestic wire rod mills bumped prices up higher than the recent shredded scrap increase, they are not necessarily expecting a positive response.

Reports from the American Wire Producers Association (AWPA) conference in Washington D.C. last week indicate overall, sentiment in the US wire rod market is grim. This lack of confidence is probably why domestic mills are only expecting to get a portion of their recently announced price increase, if they get anything at all. Many in the industry were surprised at the $1.50 cwt. ($33/mt or $30/nt) price hike, mostly because it surpassed the shredded scrap increase of $28/long ton ($1.25 cwt. or $25/nt).

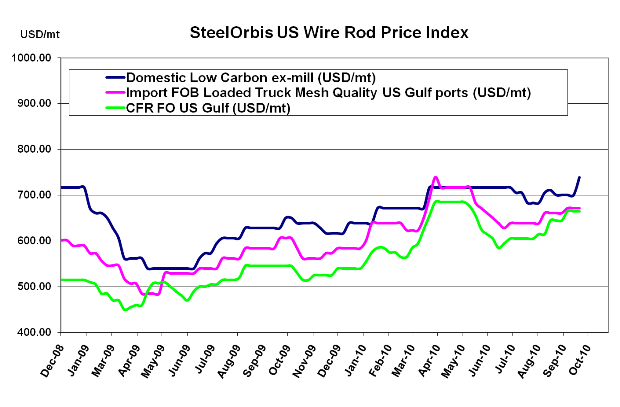

US mills are prepared to be flexible with pricing for October shipments, and the general consensus is that they will only push for $0.50-$1.00 cwt. ($11-$22/mt or $10-$20/nt) of the increase. Therefore, "official" asking prices of $33.00-$34.00 cwt. ($728-$750/mt or $660-$680/nt) ex-mill are likely to be ignored, and there's a good chance that pre-increase prices of $31.50-$32.50 cwt. ($683-$717/mt or $630-$650/nt) ex-mill will last beyond the end of the month. Additionally, there are already rumblings of a scrap price decrease in October, which is only exacerbating mills' attempts to get any relief from September's higher raw material costs.

Overseas, the scrap market is experiencing a reverse trend-many expect pricing to increase soon, which would normally affect import prices for wire rod. However, Turkish mills might take the US wire rod market into consideration and hold prices steady. Current import offers have not changed in the last week, and are still between $30.00-$31.00 cwt. ($661-$683/mt or $600-$620/nt) duty paid FOB loaded truck in US Gulf ports-although most offers are closer to the higher end of the range. With prices already too close to actual domestic prices (not taking the latest price increase into account), and speculation of lower US scrap numbers next month, there is not much incentive to raise prices any further.