Domestic pricing for wide flange beams has boosted along with raw materials, while the import market has become unusually quiet.

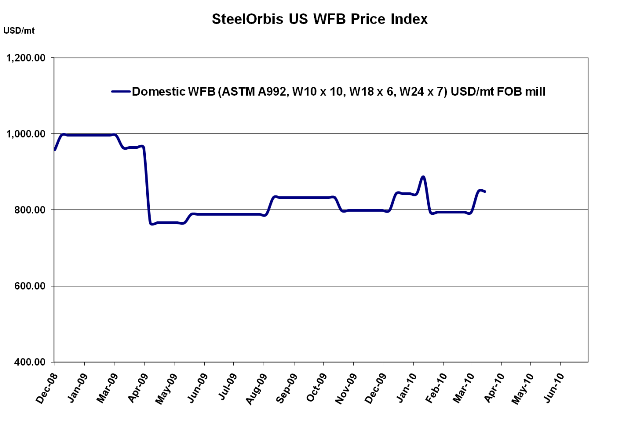

Earlier in the month, wide flange beam mills announced a raw materials surcharge (RMS) increase of $2.50 cwt. ($55/mt or $50/nt) from February's RMS. However, unlike in February, the mills did not adjust the base price to compensate, resulting in new transaction prices of $38.50 cwt. ($849/mt or $770/nt) ex-mill for ASTM A992, W10 x 10, W18 x 6, and W24 x 7. Domestic spot prices are expected to fall in line with the increase, which, aside from an anomalous spike in mid-January, translates into the highest price for WFB since the first quarter of 2009.

Part of the reason domestic mills will most likely succeed in passing through the entire RMS increase is because the import market for WFB seems to be relatively quiet. Mills withdrew "foreign fighter" deals as of March 1, but they warned customers that they might reinstate them if import activity picks up.

Most recent import offers have been from European mills, primarily from ArcelorMittal, but actual offering prices have been hard to track down. There are unconfirmed reports about ArcelorMittal establishing a base for US beam distribution through its subsidiary Skyline Steel. Skyline would be the Europe-based steel giant's sole distributor of beams, and possibly other structural products in the US, and in preparation of this, Skyline has already hired a manager from a West Coast beam distributor. Skyline is the largest piling distributor in the US, which also distributes significant quantities of Nucor's piling products. Nucor is the largest producer of beams and structurals in the US.

Overall, imports of wide flange beams to the US decreased significantly from January to February. According to the latest import data from the US Import Monitoring and Analysis System (SIMA), only 2,221.3 mt of WFB were imported to the US in February (license data), while January saw 8,368.9 mt (census data). Notably, consistent importers such as Luxembourg, Korea and Spain dramatically reduced their tonnages in February; the US imported only 369.6 mt from Luxembourg, compared to 4,356.3 mt in January; 628.7 mt from Korea, versus 2,774.8 the month before; and 10.2 mt from Spain, compared to 226.4 a month earlier. While this significant decrease could be attributed to seasonal issues and reluctance to order large tonnages before the beginning of the year, it should be noted that Korean levels are already ramping up, with license data showing 1,839.0 mt imported as of March 16. The same cannot be said for Luxembourg and Spain; the US has only imported 122.3 mt and 8.0 mt from them, respectively, so far this month.

Despite small import numbers, imports are a lightning rod for domestic mills, and even minor offers can trigger price retaliations and market drops. Therefore, the new import distribution developments will be watched carefully by producers and distributors alike.