While spot prices on US domestic plate had been slowly firming up over the past month, it appears that the most recent $2.00 cwt. ($44 /mt or $40 /nt) price increase announced by domestic mills a few weeks ago are not fully sticking.

Most distributors believe that since the last price increase, about half of it; $1.00 cwt. ($22 /mt or $20 /nt), has resonated in the spot market; however, that the full $2.00 cwt. ($44 /mt or $40 /nt) increase would most likely have to been reflected in the spot market by now for mills to even consider announcing another increase for October, or over the remainder of the year.

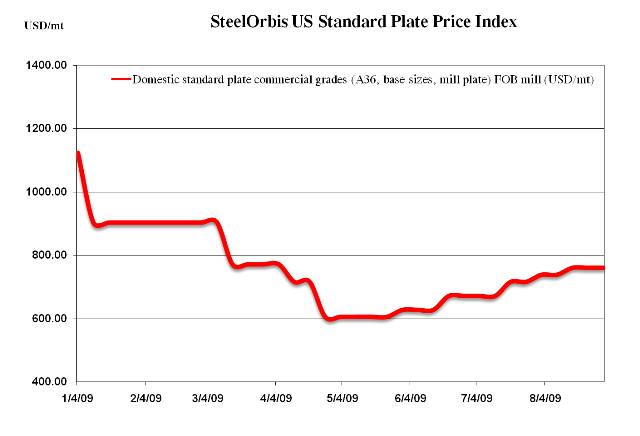

Most domestic mill transaction prices continue to range from approximately $34.00 cwt. to $35.00 cwt. ($750 /mt to $772 /mt or $680 /nt to $700 /nt) FOB mill in the Midwest (for commercial grades -- A36, base sizes, mill plate); however, even with spot offers increasing by about $1.00 cwt. ($22 /mt or $20 /nt) since our last report two weeks ago, many spot offers may still be found in the low $30s cwt. Despite domestic mills' desire to keep riding the positive momentum of the scrap and flat rolled market price increases, they may be forced to just try and keep prices neutral and avoid any possible prices decreases, especially as the slower holiday season is just around the corner.

Meanwhile, while service centers have continued to be in a destocking phase, shipments have slightly increased. According to the most recent Metal Service Center Institute (MSCI) monthly shipment and inventory report, daily and monthly shipments of plate increased from June to July, at 10,900 nt to 11,100 nt respectively for daily shipments, and 240,100 nt and 243,300 nt respectively for monthly shipments. Furthermore, total ending monthly plate inventories decreased from approximately 757,000 nt in June to 734,000 nt in July. Considering the recent shipment increase and inventory decrease, domestic mills will be looking toward increasing production again, which could lead to excess inventory especially at the end of the fourth quarter.

Nonetheless, while US mills are likely not expected to announce further price increases this year, they continue to have a little leeway from the lack of import pressure. Traders have informed SteelOrbis that there are basically no interesting offers out there. Many US ports still have excess imported plate inventory lying around, albeit of a much lesser quantity than in previous months, and some of the major southern US service centers continue to be stuck holding excess inventory. Furthermore, most offshore shore offers would delivery inventory to the US at the end of the fourth quarter, which nobody wants, however, some US buyers in need of early first quarter shipments begin at least inquire about import offers over the next month or two.

Preliminary license data from the US Import Administration demonstrates that import tonnage of cut-to-length plates slightly increased in August from July, at 24,389 mt and 22,222 respectively. Nevertheless, the bulk of the imported plate came from Canada, which increased their shipments from 13,527 mt in July to 18,711 mt in August. The two offshore sources that imported over 1,000 mt of plate to the US in July, failed to repeat their business in August. Sweden's plate exports to the US decreased from 3,144 mt in July to 506 mt in August, while Japan saw their exports drop from 1,967 mt to only 74 mt.