The US flats market has managed to continue its positive momentum over the past six weeks, with the help of surging scrap prices and a renewed automotive market. But how long will the good times last?

Domestic flat rolled prices have increased by about $6.00 cwt. ($132 /mt or $120 /nt) since late May, and the upward trend continued after Nucor announced another minimum $3.00 cwt. ($66 /mt or $60 /nt) increase on flat rolled products for August/September shipments.

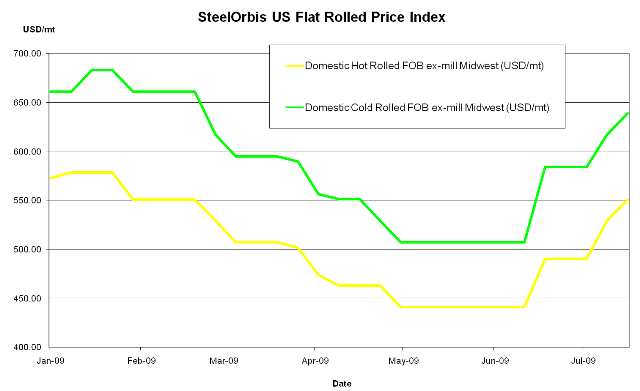

As a result, while most US domestic hot rolled coil (HRC) spot prices continue to range from approximately $23.00 cwt. to $25.00 cwt. ($507 /mt to $551 /mt or $460 /nt to $500 /nt) ex-mill in the Midwest, the majority of spot offers have now been pushed up to the higher end of the range, and are expected to continue slowly increasing upwards in the coming weeks.

Meanwhile, US cold rolled coil (CRC) spot prices have increased by an additional $2.00 cwt. ($44 /mt or $40 /nt) over the past week, and most domestic offers can now be found for around $29.00 cwt. to $31.00 cwt. ($639 /mt to $683 /mt or $580 /nt to $620 /nt) ex-mill in the Midwest, marking the first time US domestic CRC spot prices have breached the $30.00 cwt. ($661 /mt or $600 /nt) level since late February.

However, the surging momentum of scrap price increases may be cooling down and with many flat rolled mills gearing up some production again after letting inventory levels diminish to their lowest in years, producers will need to be careful to avoid creating another price bubble that is not based on demand. Still, this is unlikely to occur as mills will likely be wise enough to keep production at low enough levels to sustain their price momentum. Furthermore, imports remain absent from the US flat rolled market, and with a lot of uncertainty about the recovery, customers are still keeping inventories at low levels despite the recent price gains.

The latest Metal Service Center Institute (MSCI) monthly shipment and inventory report indicates that US flat rolled demand may have begun to pick up somewhat. Service center inventories of flat rolled steel declined from 3.4 million nt in May to 3.0 million nt in June and monthly shipments increased from 1.3 million nt in May to about 1.5 million nt in June, the first such monthly increase since March. However, the most noticeable figure from this report may be that the average inventory overhang shrank from 2.5 months in May to only 2.1 months in June; the lowest average monthly inventory overhang at US flat rolled service centers since January 2008.

Still, the question remains whether the flat rolled market will be able to sustain its current momentum through the end of the year. Many recent bookings have been to fill inventory gaps or to avoid higher prices down the road. However, since the recent price increases have been based wholly on raw material costs, rather than strong demand, flat rolled may fall back again by if US scrap prices decrease significantly in August or September.

On the import side, traders continue to inform SteelOrbis that offers for HRC are virtually dead right now, with some Mexican offers on an extremely limited basis, at around $25.00 cwt. to $27.00 cwt. ($551 /mt to $595 /mt or $500 /nt to $540 /nt) delivered to Southern California. However, as domestic spot prices continue to rise, imports from Mexico may start to penetrate the US marketplace again.

CRC import offers have been a little more prevalent but there still have not been many actual bookings. Imports will play an even lesser role in the US flat rolled market during the second half of this year, based on the lack of bookings in recent months and import lead times currently stretching out to the fourth quarter . Regardless, some Asian sources continue to offer CRC to the US at uncompetitive levels. China continues to offer CRC to the US for around $32.00 cwt to $34.00 cwt. ($705 /mt to $750 /mt or $640 /nt to $680 /nt) duty-paid, FOB loaded truck in US Gulf ports. Meanwhile, India has entered the market again, after a short hiatus, with offers ranging from approximately $32.00 cwt. to $33.00 cwt. ($705 /mt to $728 /mt or $640 /nt to $660 /nt) duty-paid, FOB loaded truck in Gulf ports.