Not too much has transpired in the US flat rolled market over the past week, as weak demand continues to contribute to lackluster sales.

The attempts of many domestic mills to raise prices late last month obviously didn't pan out, and the frail state of demand actually forced mills to establish a $1.00 cwt. ($22 /mt or $20 /nt) decrease late last week into this week. While many industry professionals believe that price decreases at the mill level will not lead to an increase in demand, mills have felt the pressure to stay competitive with import offers -- which they have.

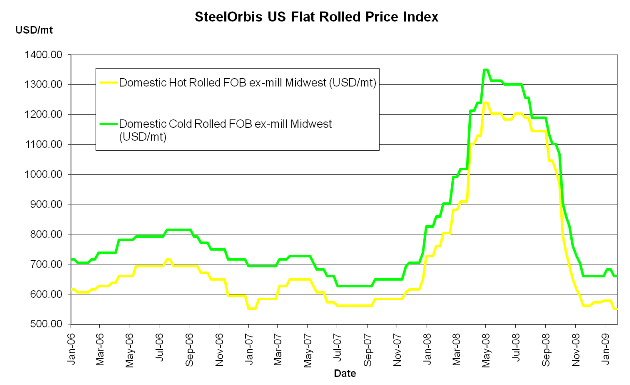

Domestic hot rolled coil (HRC) spot prices have remained unchanged from our last report in the approximate range of $24.00 cwt. to $26.00 cwt. ($529 /mt to $573 /mt or $480 /nt to $520 /nt) ex-mill in the Midwest. While the price trend appears to be neutral for the time being, most transactions are transpiring at the bottom of this range, with the possibility to further negotiate for quick delivery orders.

Most domestic cold rolled coil (CRC) spot prices have also trended neutral from our last report and continue to be in the range of about $29.00 cwt. to $31.00 cwt. ($639 /mt to $683 /mt or $580 /nt to $620 /nt) ex-mill in the Midwest. Much like domestic HRC, the bottom of this range could be negotiable; however, long-term discounts will be very tough to come by.

The overall mentality of the domestic flat rolled market right now is that everyone, especially the mills, are frustrated. The bottom of the market appeared to have been established at the beginning of this year, and demand was expected to at least trend neutral if not slightly increase. Moving forward, the market may experience another slight spot price decrease in the near future on the heels of the recent busheling scrap decrease of $30 /lt, and will continue to trend neutral to slightly down thereafter for the foreseeable future.

On the import side, the trend is similar to domestic. The general price ranges have remained neutral from our last report; however, most attractive offers are found at the lower end of the spectrum.

South American CRC import offers to the US have been emerging recently, and with more tons available, these imports are becoming very competitive in the marketplace. Brazil, Venezuela and Argentina have been the South American front-runners and are all in the approximate range, along with Mexico, of $27.00 cwt. to $29.00 cwt. ($595 /mt to $639 /mt or $540 /nt to 580 /nt). South American offers are duty-paid, FOB loaded truck in US Gulf ports, while Mexican offers are delivered to the US at the border crossing.

Meanwhile, Turkish CRC offers are also in the range of about $27.00 cwt. to $29.00 cwt. ($595 /mt to $639 /mt or $540 /nt to 580 /nt) duty-paid, FOB loaded truck in US Gulf ports; however, they are currently not as competitive as in previous weeks.

Indian mills once again have kept their prices firm from last week and remain in the range of about $28.00 cwt. to $30.00 cwt. ($617 /mt to $661 /mt or $560 /nt to $600 /nt) duty-paid, FOB loaded truck in US Gulf ports.

HRC import offers to the US continue to be most competitive from Mexico and Turkey. While both countries' offerings have remained unchanged from our last report at $23.00 cwt. to $25.00 cwt. ($507 /mt to $551 /mt or $460 /nt to $500 /nt), SteelOrbis has learned that Mexico may be more willing to negotiate below this range on quick orders with significant tonnage. Mexico offers are delivered to the US at the border crossing, while Turkish offers are duty-paid, FOB loaded truck in US Gulf ports.