In an effort to lure buyers back in the market, both US domestic and import prices of flat-rolled coated products continue to fall.

As mentioned in previous reports, buyers of hot dipped galvanized (HDG) have only been purchasing the bare minimum over the past few weeks on the heels of emerging price weakness in the US domestic HDG market. And although demand levels have been steady, pressure on the HDG market is growing due to high US domestic capacity levels.

Overall steel mill capacity utilization rates in the US were up 1.8 percent last week to 76.1 percent. While this figure is already the highest level since 2008, it's still below average flat-rolled mills' utilization rates. Sources indicate that flat-rolled mills consistently operate at about/or over 80 percent. For example, in a recent quarterly conference call, Steel Dynamics Inc. (SDI) mentioned that its flat-rolled mills operated at full capacity while AK Steel said in their Q4 conference call that their mills operate at about 82 percent of capacity.

Accordingly, while buyers report that their inventories for HDG and Galvalume are relatively low, they are putting off making any immediate purchases until the market trend is clearer. But for now, with supply outweighing demand, flat-rolled prices continue to decline. Since last week, domestic HDG and Galvalume spot prices have decreased $1.00 cwt. ($22/mt or $20/nt) across the board, with spot prices expected to drop again next week.

Cwt. | Metric Ton (mt) | Net ton (nt) | Change from last week | |

US domestic HDG base price | $46-$48 | $1,014-$1,058 | $920-$960 | ↓ $1.00 cwt. |

0.012"x40.875" G30 | ||||

ex-Midwest mill | $56-$58 | $1,235-$1,279 | $1,120-$1,160 | ↓ $1.00 cwt. |

0.019"x48" G90 | ||||

ex-Midwest mill | $57-$59 | $1,257-$1,301 | $1,140-$1,180 | ↓ $1.00 cwt. |

Galvalume | ||||

ex-Midwest mill | $46-$48 | $1,014-$1,058 | $920-$960 | ↓ $1.00 cwt. |

0.019x41.5625 Gr80/AZ55 | ||||

ex-Midwest mill | $57-$59 | $1,257-$1,301 | $1,140-$1,180 | ↓ $1.00 cwt. |

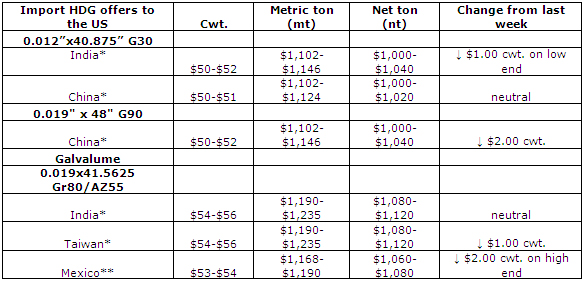

US buyers are also skeptical of putting too much stock in imports, driving offshore mills to lower offers to the US again this week. Indian offers of HDG 0.012"x40.875" G30 have dropped $1.00 cwt. on the low end since last week to $50.00-$52.00 cwt. ($1,102-$1,146/mt or $1,000-$1,040/nt) duty-paid FOB loaded truck in US Gulf ports. Chinese HDG 0.019" x 48" G90 offers have dropped $2.00 cwt. ($44/mt or $40/nt) in the past week to $50.00-$52.00 cwt. duty-paid FOB loaded truck in US Gulf ports.

As for import offers of Galvalume 0.019x41.5625 Gr80/AZ55, Mexican prices have dropped $2.00 cwt. on the high end to $53.00-$54.00 cwt. ($1,168-$1,190/mt or $1,060-$1,080/nt) FOB loaded truck delivered into Houston and are expected to continue to soften through the end of April. Indian and Taiwanese offers are now both $54.00-$56.00 cwt. ($1,190-$1,235/mt or $1,080-$1,120/nt) duty-paid FOB loaded truck in US Gulf ports, and traders tell SteelOrbis that those prices will also come down at least another $1.00-$2.00 cwt. by early May.