Demand in the Turkish hot rolled coil (HRC) market has remained sluggish at the start of this week following the municipal elections in Turkey held on March 30. Market players say that demand has been postponed for a while now and, with the elections completed, purchases which had been postponed may be seen in the market towards the end of the week and transaction activity may show some recovery.

Traders say that, despite the expectations for a recovery of demand in the Turkish HRC market, shipments for April ordered at lower prices have started to enter stocks and, if the domestic political tensions continue, this might result in declines in HRC spot prices, which have remained unchanged week over week.

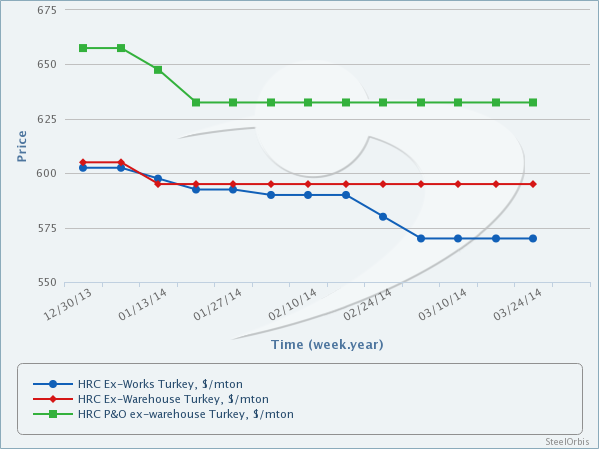

On the other hand, Turkish HRC mills have increased their prices by 5-10$/mt due to the rise in raw material prices. No transaction has been completed at these higher prices so far but HRC producers in the Turkish market are maintaining a firm stance on their prices. Despite the expectations for a recovery of demand, market players believe HRC mills will continue to raise their prices. Moreover, due to the ongoing and upcoming overhauls at mills, HRC supplies in the market are expected to shrink. HRC mills' prices in the Turkish domestic market are currently at $565-590/mt ex-mill.

The domestic sales prices of traders for local and imported hot rolled flat steel products in the Eregli and Gebze regions of Turkey are as follows:

Product | Price ($/mt) | |

Eregli | Gebze | |

2-12 mm HRC | 590-600 | 595-600 |

2-12 mm HRC (for large volume sales) | 580-590 | |

1.5 mm HRS | 620-630 | 625-635 |

3-12 mm HR P&O | 625-630 | 635-640 |

The above prices are ex-warehouse and for advance payments, exclusive of 18 percent VAT.

Weekly price movements of different steel products in major markets can be viewed comparatively in the SteelOrbis Historical Steel Prices section. Market trends can thus be seen more clearly, while desired charts can be created and used in reports or presentations.