Before focusing directly on the Turkish flats sector, it may be beneficial to take a brief look at recent news and figures relating to the economic situation in Turkey;

- Türk Traktör has laid off 249 employees.

- Four textile factories have been closed in Tekirdağ

- Capacity utilization rate in the Turkish manufacturing industry decreased to 63.8 percent in February, indicating a drop of 15.5 percentage points from the same month of last year. The automotive sector in Turkey, one of the main sub-sectors of the country's manufacturing industry, experienced its most rapid drop ever in capacity utilization rate in February.

- Capacity utilization rate for vehicle and car body manufacturing has decreased to 47.5 percent, declining by 42.5 percentage points.

- The unemployment rate in Turkey has reached its highest historical level after increasing by 16.6 percent in December. The number of unemployed has increased by 838,000 persons year on year.

As seen from the above data, the crisis has gained depth in Turkey. All sectors are significantly affected, with many steel mills halting production and laying off employees. Steel consumption has continued to decrease. The big decrease in Turkey's manufacturing industry exports has also resulted in a decrease in the country's flat steel consumption. Although the flat steel market in Turkey would have been expected to register its usual seasonal recovery by now, it has instead continued to decline further with each passing day. Currently, foreign mills' offers for 2 mm HRC have decreased to the range of $360-380/mt, while local mills' offers have fallen to $410-430/mt. With 2 mm hot rolled coil prices declining to €300/mt in the local European markets, the decreases seen in Turkey appear to have been inevitable. Thus, it may be correct to say that prices in Turkey have settled at the appropriate levels.

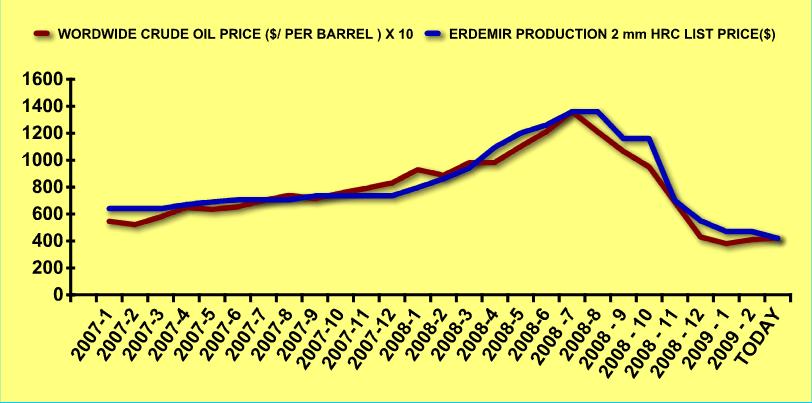

If we look at the graphics presented below comparing oil prices and Erdemir's local sales prices (an updated version of the graph we published several months ago showing the correlation among commodity prices), we can see that the correlation in question has continued to be maintained.