SteelOrbis has learned from market sources that hot dip galvanized coil (HDG) demand in the local Turkish market remains strong as compared to demand in export market. Meanwhile, prices in the Turkish HDG market have remained unchanged since last week and discounts of up to $10/mt are still available depending on transaction volumes. Turkish producers, who are not willing to soften their export offers due to the weak demand in the export markets, prefer to focus on their domestic market, where demand is stronger and prices are at reasonable levels.

Turkey’s HDG exports are facing very strong competition, while the asking prices of foreign buyers are significantly lower than what Turkish producers are offering currently. Some Turkish HDG producers have slowed down their export activities considerably since buyers are asking for prices approximately $40–50/mt lower than ex-Turkey offers.

In the Turkish domestic market, current HDG sales prices are as follows:

| Product | Price ($/mt) |

| HDG 0.50 mm 100gr/m² | 800-820 |

| HDG 1 mm 100gr/m² | 750-770 |

| HDG 2 mm 100gr/m² | 740-750 |

The above prices, which may differ depending on product quality, are ex-works, exclude VAT, and are for advance payments.

Offers for December production HDG from Turkey to certain Middle Eastern and CIS markets are currently in the range of $790-810/mt ex-mill.

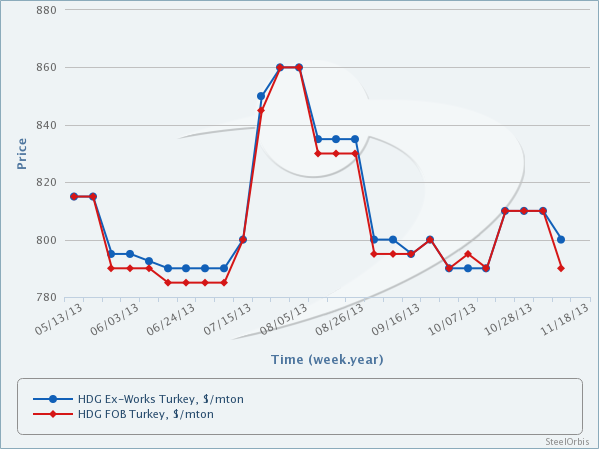

Weekly price movements of different steel products in major markets can be viewed comparatively in the SteelOrbis Historical Steel Prices section. Market trends can thus be seen more clearly, while desired charts can be created and used in reports or presentations.