According to data released this week by the Turkish Union of Chambers and Commodity Exchanges (TOBB), Turkey's exports to its major market, the European Union, have decreased from 60 percent to 55 percent compared to last year. The reason behind this is that the financial crisis seen in the European markets has been reflected in the real sector. The European Union is the major export destination for Turkey's flat steel products, including automotive, white goods, pipes, panel radiators, machines, etc.. The shrinkage seen in the EU will have a negative impact on the abovementioned sectors, leading to a direct decrease in flat steel consumption.

Hardly any recent bookings of material have been realized in Turkey, which satisfies most of its flat steel needs from abroad. Nowadays, bookings are being concluded only for project-based work and in order to satisfy certain minimum supply requirements. Due to the general expectation in the market that prices will decline further, material purchases have difficulty in rising above certain levels. The fluctuations in the $-€-TRY exchange rates are having a direct impact on flat steel products, as well as on all other steel groups. The rapid changes seen in the exchange rates have been damaging confidence in the sector and firms are now even more cautious when it comes to making decisions.

Meanwhile, developed countries are currently injecting money into the markets of certain countries in order to boost the global financial markets. In order pay back this money, the countries in question will inevitably be obliged to go on saving. This situation will be reflected in general consumption and the real sector will show further shrinkage in the coming days. As is known, the consumer indexes have decreased in both the US and EU. By nurturing the necessary confidence in the financial markets, the real sector be boosted and cash will start to flow again. However, until this happens, it seems futile to expect any turnaround in the flats markets.

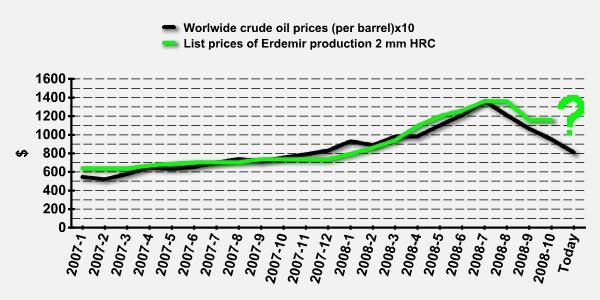

As regards prices in the domestic market, the issue of restoring confidence in the markets is more important than the actual price decreases seen currently. In Turkey's domestic market, the prices of Erdemir production 2 mm HRC are standing at levels of $850-900/mt, while imported 2 mm HRC are being offered at around $800-850/mt. The graph below shows the relationship between oil prices and Erdemir production 2 mm HRC. According to the past trend, it is seen that Erdemir is likely to decrease its prices in the near future.

Despite this pessimistic table, the steps taken by developed countries indicate that all countries will do their best to overcome the current financial crisis and that the situation may be reversed. Consideration that all steel producers and OPEC have decreased their production levels, the supply and demand imbalance can expect to return to normal soon. When this happens, with the approach of spring 2009, it is likely that purchasing activities will again start to take off in the flat steel markets, though gradually.