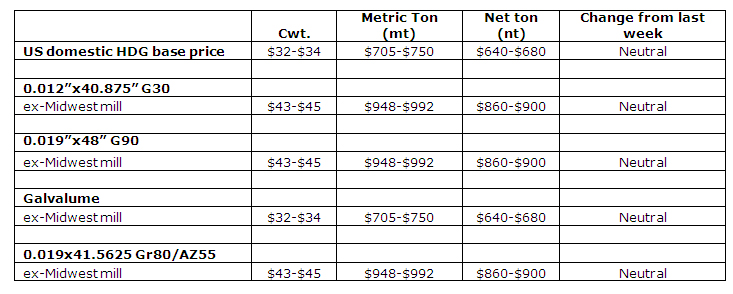

Spot prices in the domestic hot dipped galvanized market (HDG) market have trended sideways since our last report a week ago., as lackluster demand from the construction industry continues to keep HDG the weakest product in the flat-rolled market.

Spot prices for HDG and Galvalume base products and extras remain unchanged from our last report a week ago, however "weak-at-best demand from the construction market has most transactions for HDG products trending towards the lower end of the price range," one East Coast trader explained to SteelOrbis.

Still, overall demand levels have not significantly tapered off in past months, and although both monthly and daily shipments of flat-rolled products from steel service centers fell approximately 4 percent from September to October according to the latest data from the Metal Service Center Institute (MSCI), the 1.8 million nt shipped last month is still 12.8 percent higher than the 1.6 million nt shipped last October. Furthermore, full December order books will likely result in a significant increase in January and February shipment levels.

Higher domestic prices for HDG products are forecasted to remain firm through at least January, but the positive momentum may very well continue into February as likely increases in the cost of raw materials in the first month or two of the new year will inherently affect flat rolled transaction prices.

Delivery of coated products by year's end is no longer a possibility, as planned one-to-two week shutdowns in production in December from a number of mills have pushed lead times well into January.

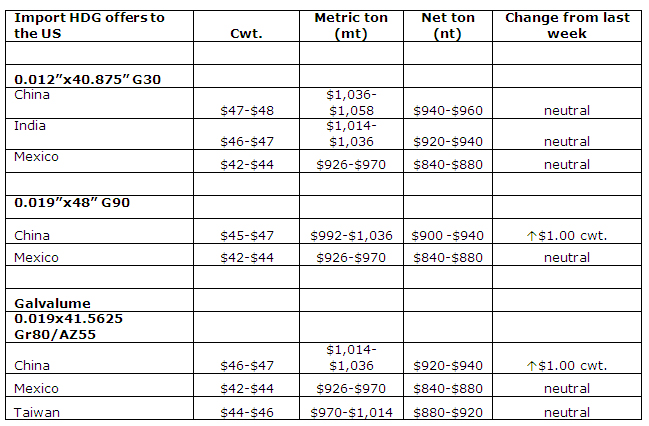

Looking offshore, Chinese offerings of Galvanized 0.019x48 G90 and Galvalume 0.019x41.5625 Gr80/AZ55 have come up $1.00 cwt. ($22/mt or $20/nt) and have generated some attention from domestic buyers, while Indian and Taiwanese offers of coated products appear hard-pressed to find interested buyers. Mexican offers of HDG and Galvalume have remained relatively neutral from last week, with offers now only being quoted for January deliveries at the earliest.