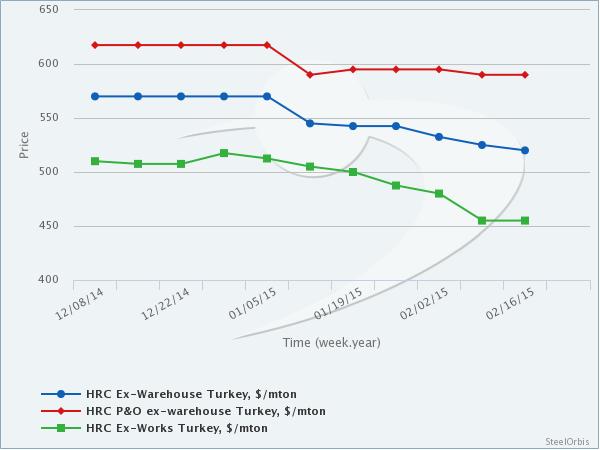

Activity in the local Turkish hot rolled coil (HRC) market has continued to be characterized by sluggishness during the past week, while traders have cut their prices by $10/mt except for pickled and oiled coils, the prices of which have remained unchanged. Turkish traders state that weakness in demand along with the price declines seen in the global HRC market have forced them to revise their price levels.

Meanwhile, Turkish steel producers have maintained their HRC prices in the range of $450-460/mt ex-works, after the $20/mt reduction recorded last week. Despite the weak trend of HRC prices in the global market, Turkish producers state that they will maintain their current price levels for another while to provide support for local prices. No new HRC deals have been heard in this price range yet.

The domestic sales prices of traders for local and imported hot rolled flat steel products in the Eregli and Gebze regions of Turkey are as follows:

Product | Price ($/mt) | |

Eregli | Gebze | |

2-12 mm HRC | 500-520 | 505-525 |

1.5 mm HRS | 530-550 | 535-555 |

2-12 mm HRC (for large volume sales) | 490-510 | |

3-12 mm HR P&O | 580-590 | 595-600 |

The above prices are ex-warehouse and for advance payments, exclusive of 18 percent VAT.

Weekly price movements of different steel products in major markets can be viewed comparatively in the SteelOrbis Historical Steel Prices section. Market trends can thus be seen more clearly, while desired charts can be created and used in reports or presentations.