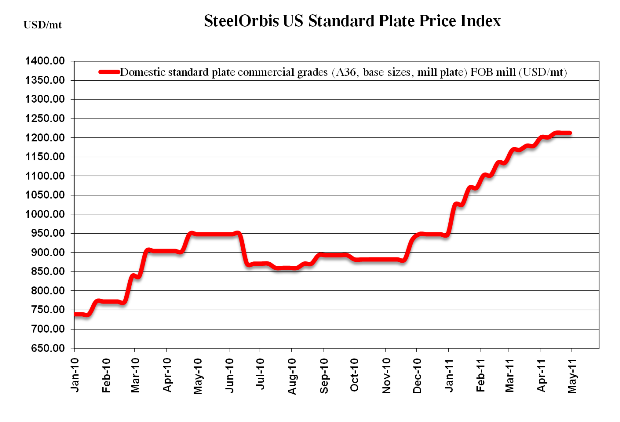

Spot prices look to be hitting a wall in the US domestic plate market, and with an abundance of heavily discounted import offers, US prices may begin to decline by late Q2.

While demand from original equipment manufacturers (OEMs) and certain end-use sectors, primarily bridge construction, energy, rail cars and wind towers, remain bright spots in the overall economy, and have been driving plate demand in the US, it may not be enough to hold up current US domestic spot prices for much longer. Service centers have had difficulty since the start of 2011 getting the resale price up from rapidly rising US domestic spot prices, and with little spot tonnage available domestically, many have been looking to offshore sources to hedge against higher US prices.

For now, US domestic plate spot prices are still in the range of $54.00-$56.00 cwt. ($1,190-$1,235/mt or $1,080-$1,120/nt) ex-Midwest mill-unchanged from mid-April. The $2.00 cwt. ($44/mt or $40/nt) plate price increase announced in early April (for May deliveries) was expected to be fully absorbed by early May, however most mills have not been able to get the full increase-only about $1.00 cwt. ($22/mt or $20/nt) of the increase has been absorbed. And another increase announcement for June deliveries was anticipated in the next few weeks, although discussion of such an increase have quieted now that new import offers for the US are being offered as much as $9.00 cwt. ($198/mt or $180/nt) below US domestic plate spot prices.

New Russian offers of steel plate for the US are approximately $45.50-$46.50 cwt. ($1,003-$1,025/mt or $910-$930/nt) duty-paid FOB loaded truck in US Gulf ports. Turkish offers of plate into the US are within the same range; sources tell SteelOrbis that with the unrest in the M.E.N.A. (Middle East North Africa) region, Turkish mills, which do not consistently export plate to the US, have been looking for alternative destinations for the commodity. Romanian offers are also still available in the $48.00-$50.00 cwt. ($1,058-$1,102/mt or $960-$1,000/nt) duty-paid FOB loaded truck in US Gulf port range-unchanged from our last report two weeks ago-however, with new offers from Russia and Turkey significantly below, interest in the Romanian offer has been waning.

While both Turkish and Russian offers are for July/August delivery, the spread between US domestic spot prices for June delivery and the import prices is significant enough for many to seriously consider purchasing offshore plate. With no drop-off in US plate demand levels evident, the likely softening in US spot prices is not expected to be drastic, making orders placed today still valuable by early/mid-Q3.