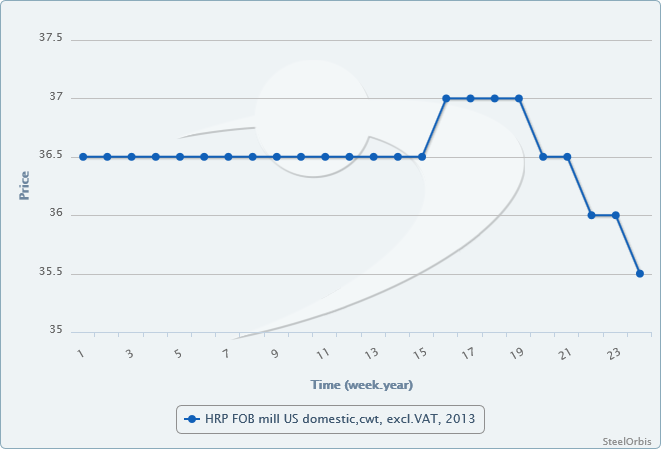

US domestic plate spot prices have continued their descent this week, fueled by a demand slowdown and import competition. Predictions in mid- to late May for another weak scrap market in June were one factor pushing down US domestic plate prices, and keeping buyers on the sidelines. However, even though the scrap market settled at sideways to only slightly down prices, it has done little to prevent the plate spot price slide. Customers are wary of stocking inventories ahead of what could be a summer slowdown, and overall demand appears less robust than just a month or two ago, according to service center sources. As a result, spot prices have come down another notch to $35.00-$36.00 cwt . ($772-$794/mt or $700-$720/nt) ex-Midwest mill, a $0.50 cwt. ($11/mt or $10/nt) decrease in the last two weeks. But even the newly lower prices aren't entirely firm, and larger orders have been heard garnering slight discounts.

Import competition has also contributed to the softening US domestic spot market. Not only have futures offer prices been competitive as of late, but buyers tell SteelOrbis that many are concerned that too many orders for position tons have been placed and the imported plate could pressure US domestic prices when it finally hits US ports. Current plate import offer prices are relatively stable at $31.00-$32.00 cwt. ($683-$705/mt or $620-$640/nt) DDP loaded truck in US Gulf ports from Turkey. While Turkish plate has been the most often booked in the past few weeks, Korean and Taiwanese plate is available at prices $0.50-$1.00 cwt. ($11-$22/mt or $10-$20/nt) higher.