The demand revival which started last week in the local Turkish HRC market has accelerated over the past week, with demand no longer weak but now at medium levels. Market sources state that current HRC stocks in the local market are above medium levels, though prices remain firm due to rising demand. In the coming days, both demand and prices in the Turkish HRC market are expected to increase. On the other hand, this week HRC quotations in the Turkish spot market have remained unchanged compared to last week.

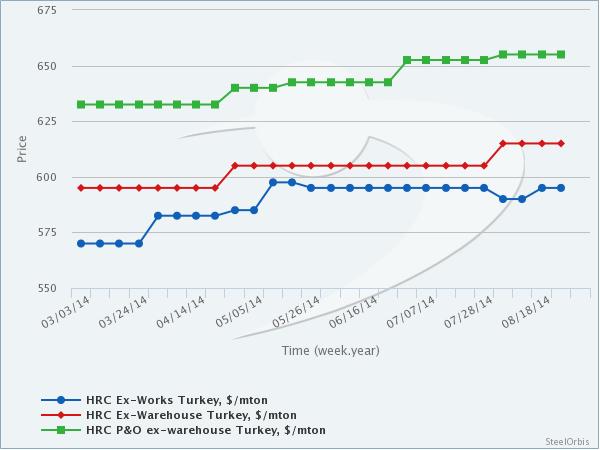

Meanwhile, demand for Turkish producers' HRC has remained on the strong side. Meanwhile, the HRC list prices of Turkish producers for their domestic market are still in the range of $590-600/mt ex-works. Market sources state that producers have filled their order books for September and are now accepting orders for October. In the meantime, it is heard that the Turkish producers plan to increase their quotations on the back of strong demand. Additionally, market sources report that Izmir-based producer Habas, which recently commissioned a new hot strip mill, has started shipments to the Turkish domestic market.

The domestic sales prices of traders for local and imported hot rolled flat steel products in the Eregli and Gebze regions of Turkey are as follows:

Product | Price ($/mt) | |

Eregli | Gebze | |

2-12 mm HRC | 610-620 | 615-625 |

2-12 mm HRC (for large volume sales) | 600-610 | |

1.5 mm HRS | 640-650 | 645-655 |

3-12 mm HR P&O | 650-660 | 660-670 |

The above prices are ex-warehouse and for advance payments, exclusive of 18 percent VAT.

Weekly price movements of different steel products in major markets can be viewed comparatively in the SteelOrbis Historical Steel Prices section. Market trends can thus be seen more clearly, while desired charts can be created and used in reports or presentations.