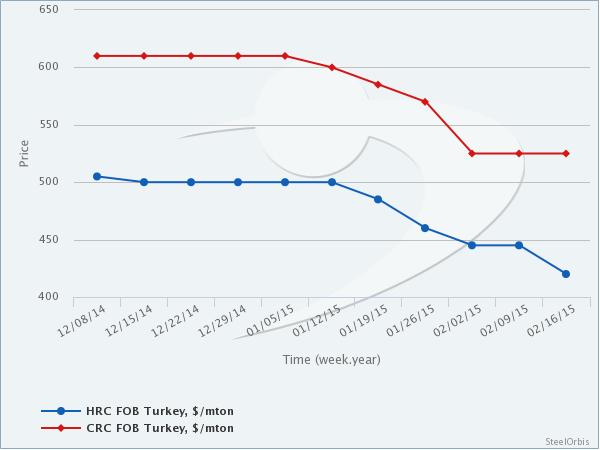

According to market sources, demand for Turkish flat steel in the export markets has revived in the past seven days. Turkish hot rolled coil (HRC) offers to the export markets have declined by $25/mt in the same period to the range of $410-430/mt FOB, while HRC sales from Turkey to Italy, Spain, Portugal, Tunisia, Algeria, the UK, France, Thailand, the US and Canada have started during the past week. While demand for Turkish HRC in the export markets has improved, demand in the local Turkish market has remained sluggish. In this context, a major Turkish producer increased its local HRC prices to $450-460/mt ex-works this week, with the aim of encouraging local market players to start concluding new transactions, while the reaction of Turkish traders to this move is still awaited.

Demand for Turkish cold rolled coil (CRC) in the export markets has seen a further gradual weakening over the past week, remaining quiet. The gap between Russian and Chinese CRC offers has narrowed, while competition in the global market has heated up significantly. Turkish CRC offers to the export markets have remained unchanged since last week in the range of $520-530/mt FOB, failing to gain acceptance in the market. With Chinese CRC offers at $515/mt FOB and Russian CRC offers in the range of $490-520/mt FOB, it is getting harder for Turkish producers to compete in the export markets.

On the other hand, Ukrainian HRC offers to Turkey have declined by $10/mt over the past month to $410/mt CFR, while Ukrainian CRC prices to the same destination have declined by $5/mt during the same period to $495/mt CFR. Although these offers are below the price levels in the local Turkish HRC and CRC markets, they have failed to gain acceptance and Turkish buyers have continued to conclude their purchases only in line with their needs.

Weekly price movements of different steel products in major markets can be viewed comparatively in the SteelOrbis Historical Steel Prices section. Market trends can thus be seen more clearly, while desired charts can be created and used in reports or presentations.