The Turkish domestic flat steel market has remained sluggish again this week. While domestic flat steel demand in Turkey has not witnessed any improvement, prices have remained almost unchanged. According to traders, the slow transaction situation in August has resulted from the strengthened US dollar, the quietness due to Ramadan and the summer lull. However, the Turkish flat steel market is expected to witness increased activity in September, after the one-week-long Ramadan holiday. Consequently, flat steel prices in Turkey are foreseen to trend sideways or increase slightly.

Turkish steelmaker Erdemir has increased its prices for October. Besides, Colakoglu Metalurji and MMK-Atakas have kept their hot rolled coil (HRC) prices unchanged, despite slack demand. In addition, import flat steel offers given to Turkey have increased. All these factors have contributed to curbing any price declines. In the meantime, since traders have placed orders with local producers at increased prices as compared to the previous month, spot prices are expected to increase in the coming months. Erdemir is currently offering October production HRC to the domestic market at $760/mt ex-works, while its 1-1.5 mm cold rolled coil (CRC) offers are at $915-930/mt ex-works. Colakoglu Metalurji and MMK-Atakas, on the other hand, are offering HRC at about $750/mt ex-works.

There has not been any significant price changes in the slow trending spot market. Accordingly, HRC spot prices this week have remained at $760-780/mt, and prices of CRC of 1-1.5 mm thickness have been at $890-910/mt, both ex-warehouse. Thinner gauge CRC prices have been at $930-970/mt ex-warehouse.

As SteelOrbis has previously reported, ex-Russia and Ukraine offers to Turkey have increased in August. Russian steelmakers Novolipetsk Steel (NLMK) and Magnitogorsk Iron and Steel Works (MMK) are offering HRC to the Turkish market at $750/mt CFR, while the HRC offers of Severstal are at $760-770/mt CFR. In the meantime, Russian steel producers are offering CRC to Turkey at the price range of $850-870/mt CFR.

On the other hand, Ukrainian HRC offers to Turkey have increased by approximately $20-30/mt in August, reaching $720-725/mt CFR. In line with anticipations for better demand in the Turkish flat steel market in September, new offers are predicted to remain stable or slightly increase.

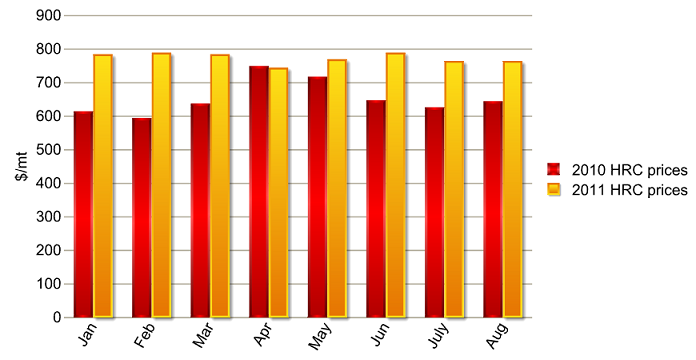

SteelOrbis Steel Reference Prices - HRC spot market price (ex-warehouse)

As can be seen in SteelOrbis Steel Reference Prices, last year HRC spot prices had continuously declined from April to July and slight upticks had been registered by August. In 2011, the lowest HRC spot prices were registered in April.

In the January-August period of 2011, the fluctuations in HRC spot prices were lower as compared to 2010. Not regressing much below $750/mt ex-warehouse, HRC spot prices have been maintained at $760/mt ex-warehouse even under the low demand conditions of August. Considering local producers' offers and import offers are now tending upwards, prices are foreseen to remain at current levels or move upward slightly.