We are currently witness to what WSD considers to be steel pricing anomalies--i.e., pricing spreads that are not sustainable. Here are some examples.

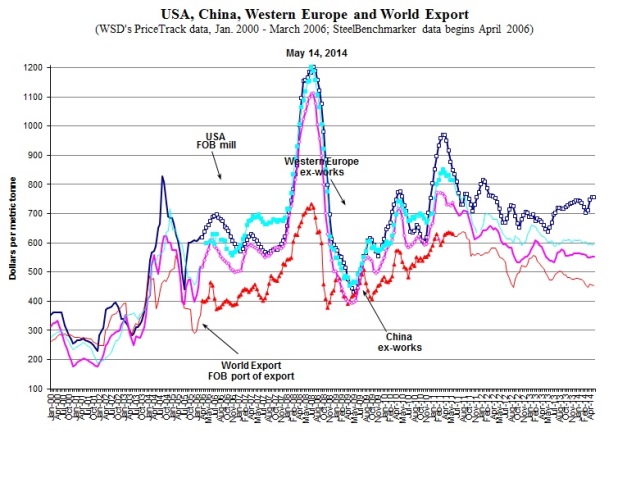

- The huge price premium for HRB in the US versus the world price and the Chinese mills' ex-works price. The figures per metric ton are $760, $545 and $455 respectively. (Note: If there was a liquid futures market for these products, we suspect that many "investors" would seek to play these spreads.)

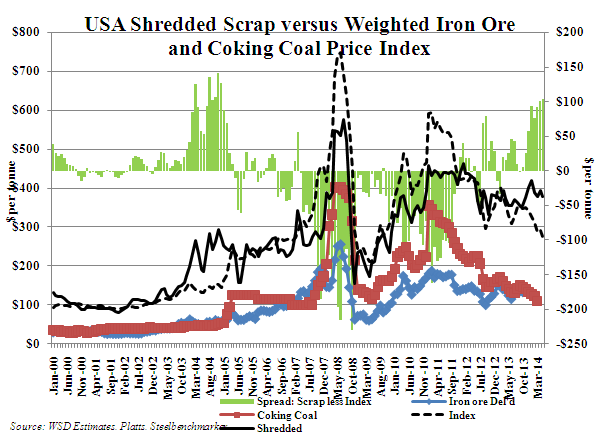

- Steel scrap and merchant pig iron price appear quite high versus the international prices of iron ore and coking coal. As indicated in the graphic on the next page, the premium for the steel scrap price at about $100 per ton is lofty. (Note: Might the spread narrow because iron ore and coking coal rise in price and the steel scrap price stays flat?)

- US shredded steel scrap appears at least $50 per ton, if not $75 per ton, overpriced relative to the aggregated value of iron ore (when multiplying its price by 1.6) and coking coal (when multiplying its price by 0.8)--which is done to model the cost of these items per ton of pig iron. As indicated in the accompanying graphic, steel scrap appears to be substantially overpriced based on this analysis (which is theoretical).

- Steel slab is high priced on the world market relative to the export price of hot-rolled band. For example, the price of slab delivered to the Far East may be about $535 per ton, say our contacts, while slab price delivered to the USA may be closer to $555 per ton. Currently, the world export price for hot-rolled band is only about $10-30 per ton above this figure. How do we explain the strong slab price? One reason is that some sellers have held back their offerings. Also, the ArcelorMittal plants in Brazil and Western Mexico are now providing up the three million tons of slab annually to the former ThyssenKrupp USA facilities in Alabama (now owned by ArcelorMittal and NSSMC). And, it takes at least six months for a new supplier of a specialized slab product to become qualified.

The rebar and wire rod offering prices on the world market by the Chinese steel mills-- and, perhaps, in the future by Russia/Ukraine steel mills--are about $485-500 per ton, FOB the port of export, which is $50-70 per ton less than the offering price by steel-scrap-using EAF steelmakers who make these products in Turkey, Japan, South Korea and, to some extent, India. We call this condition “disintermediation steel industry style" because the high-cost providers are being eliminated from the supply chain.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2014 by World Steel Dynamics Inc. all rights reserved