Example #1: Two large numbers are subtracted from one another, with the remainder subject to a large error.

In our global metallics balances system, we calculate for 2013 that the demand for steelmakers’ and foundry producers’ metallics was 1.98 billion tonnes based on aggregating the data for 44 countries. Then, we subtract by country pig iron production, home and new scrap generation and steel scrap substitute production--which adds up to 1.63 billion tonnes. The remainder is equal to the global requirement for obsolete steel scrap, which is 356 million tonnes.

Example #2: The after-the-fact revisions of the Chinese annual steel and iron ore production figures.

In February of 2013, there was a major upward revision in the steel production data for 2012, causing us to adopt a new figure of 731 million tonnes versus the December 2012 estimate of 679 million tonnes. In the case of iron ore, CISA in the summer of 2012, revised down by 14 percent China’s gross iron ore production for 2011 to 1,144 from 1,327 million tonnes, with the figures for 2012 and the following years based on the revised 2011 figure.

Example #3: A number becomes so large that a 10 percent increase or decrease in it is a huge amount.

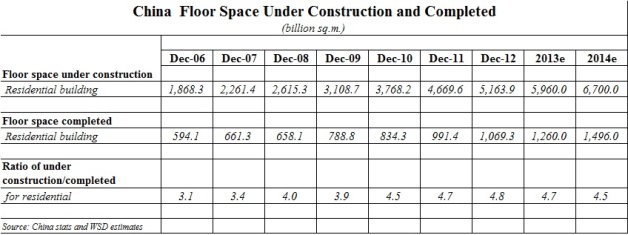

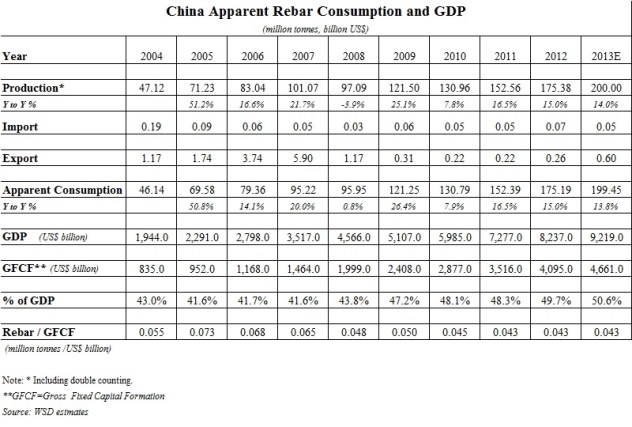

Chinese residential construction in 2013 was estimated at 5,960 billion square meters. Hence, a 10 percent increase would be an astounding 596 million square meters of floor space (which is estimated for 2014). On a related basis, rebar production in 2013 was about 200 million tonnes; thus, a 10 percent rise in 2014 would be 20 million tonnes (which is more than three times the rebar production in the United States in 2013).

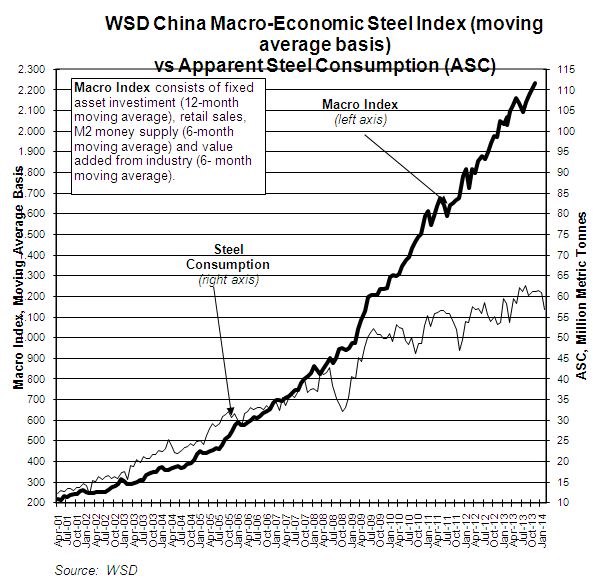

Example #4: The Chinese macro-economic data figures in many cases are not accurate. They are impacted by reporting inconsistencies and seasonal adjustments.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2014 by World Steel Dynamics Inc. all rights reserved