The Chinese steel exporting armada not yet defeated

Its steel mills the past few years have several times cut the HRB export price to remarkably low levels – i.e., well below the marginal cost of the median steel mill – when there’s sizable excess supply in their home market. In April 2017, for example, the Chinese steel mills reduced their HRB export price, FOB the Chinese port, to just $407 per tonne from $515 per tonne a month earlier, which was probably by far the greatest discount for an export price versus the average of the others in the history of the industry – i.e., $70-80 per tonne below what a number of the other exporting mills were offering.

What’s new is that, starting in the fall of 2016, the Chinese mills’ exports have become far more constrained by the avalanche of trade suits filed against them – that, in fact, has led to a new “Era of Protectionism” in the non-Chinese steel industry. In a good number of countries, the home-country steel mill is now able to sustain its hot-rolled band price at a level well above the world price.

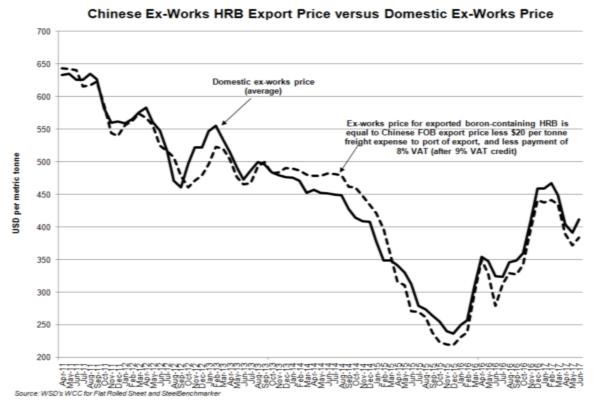

Up to the present, most of China’s medium- and larger-sized steel mills have not significantly cut back their capacity. Hence, they remain a continuing major threat to the steel mills elsewhere, especially when oversupply in China’s home market is substantial, because of their low export price proclivity. (Note: Interestingly, reflecting the 75+ wide hot-strip mills in China that are vying for market share, the mills’ HRB home ex-works price tends to mimic their export price as indicated in the accompanying exhibit. Is this extreme sensitivity of the home price to the export price the Achilles’ heel of the Chinese steel mills because they can’t long sustain such a low export price – and, therefore are vulnerable to loss of export market?)

What are the non-Chinese international mills to do? Here’s a “tough love” strategy for them.

It’s two pronged:

First, use “jawboning” tactics to make Chinese policymakers feel some guilt about their mills’ low priced offerings. Perhaps they will offer to engage in voluntary export restraints (VERs) that limit quantitatively their exports to some markets.

Second, seek to drive down the Chinese mills’ market share in selected non-Chinese-restricted export markets that account for perhaps 50% of their export deliveries – such as South Korea, Vietnam, The Philippines, Indonesia, Pakistan, and selected Middle Eastern and South American countries. If, in fact, the Chinese export deliveries fall back even further or don’t rally from already-reduced levels and, concurrently, demand for steel in China weakens (possible later in 2017), the Chinese steel mills’ operating rate might be driven down so significantly that this sparks a new period of ultra-low prices, losses and discouragement about the steel production outlook. This adverse situation could spark a decision to engage in aggressive capacity reductions, with a side benefit being of reduced air and water pollution. The government would help paying for the retraining and relocating some of the steelworkers. And, in some cities, when steel plant assets are abandoned, new factories and apartments soon occupy the land. If so, and this is a dream, the consequence might be a far better global supply/demand balance.

Of course, the non-Chinese mills would be faced with another huge challenge, which is to sustain the export price in markets in which Chinese steel deliveries are restricted. In effect, the result would be a two-tiered world export market. Is a two-tiered market another dream, or, will necessity become the mother of invention?