This market structure in a number of respects is a "worst case" scenario from the viewpoint of the iron ore producers for the iron ore price delivered to China. Given the low operating cost of the leading iron ore companies and the massive iron ore oversupply, the price for 62%-Fe iron ore sinter feed delivered to China could decline in the next six months to about $45 per tonne. This price compares to the mid-March price of about $55 per tonne, and the price last summer of about $94 per tonne.

The average production cost at the port of export for the leading producers - Rio Tinto, BHP Billiton, Vale and Fortescue - is only about $21 per tonne at the present time; and, the incremental cost when adding to capacity is far lower in some cases. The iron ore world cost curve has declined significantly the past year reflecting: a) several dollars per tonne of savings due to lower prices for fuel oil and diesel fuel; and b) the sharply weakened Brazilian Real versus the U.S. dollar, now at 3.24 per USD from 2.27 per USD in March 2014 (off 43% in the past year) and Australian dollar, at 0.76 per USD down from 0.93 per USD in March 2014 (off 18% in the past year).

The freight cost to deliver iron ore to the Chinese port of import in the past nine months has fallen, from Brazil, to about $10 per tonne from a peak of $26 per tonne in October 2014; and, from Australia, to about $4 per tonne from a peak of about $10 per tonne in August 2014.

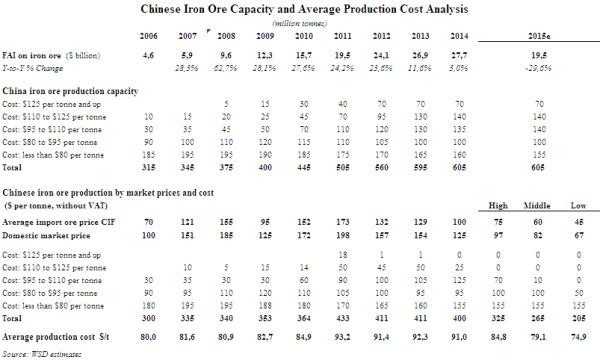

In the accompanying exhibit, WSD's Liu Jinghai, who's in charge of our Chinese research, estimates aggregated Chinese iron ore concentrate and pellet deliveries in 2015 given: a) different pricing scenarios for 62%-Fe iron ore sinter feed delivered to China; and b) a premium of about $22 per tonne for the sinter feed price inside China versus the price delivered to the port of import (due to the higher Fe content and the extra transport cost from the port to the Chinese steel plant). In 2014, Chinese iron ore concentrate and pellet deliveries amounted to about 400 million tonnes (a disputed figure), while the domestic price averaged about $125 per tonne excluding the 17% VAT.

In the accompanying exhibit, Chinese iron ore concentrate costs and deliveries are displayed in six tiers. Chinese concentrate and pellet deliveries in 2015 are estimated to be:

- 325 million tonnes if the domestic price averages $97 per tonne (not VAT).

- 265 million tonnes if the domestic price averages $82 per tonne

- 205 million tonnes if the domestic price averages $67 per tonne.