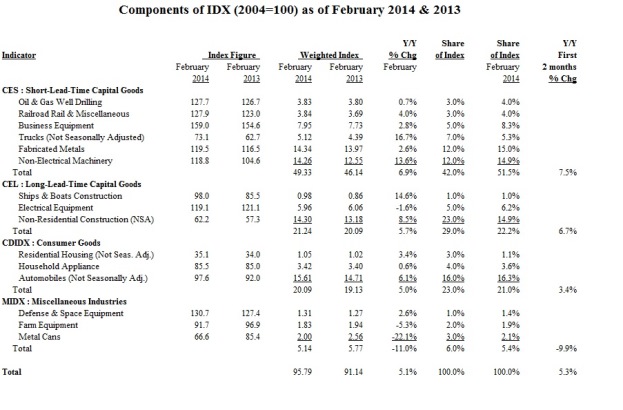

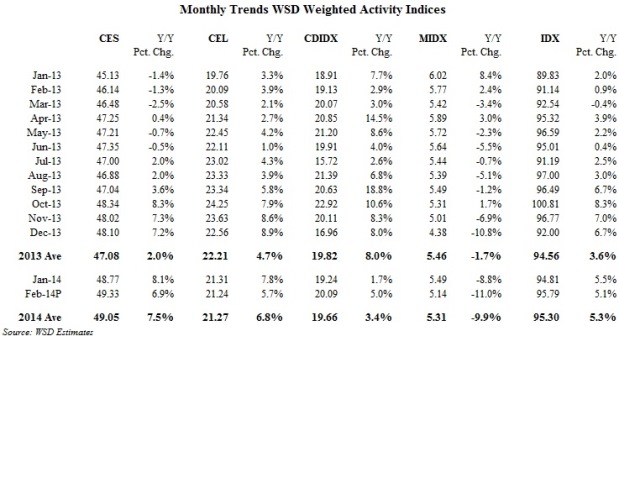

As of February 2014, WSD’s industries activity index (IDX) was up 6.9% year-to-year for the short-lead-time capital goods index; up 5.7% year-to-year in the long-lead time capital goods index, and up 5.0% in the consumer goods index. The first two indices account for about 70% of the total weighting of the index. Overall, in February 2014, IDX was up 5.1% year-to-year, which compares to 6.7% in December 2013 and 3.6% for all of 2013.

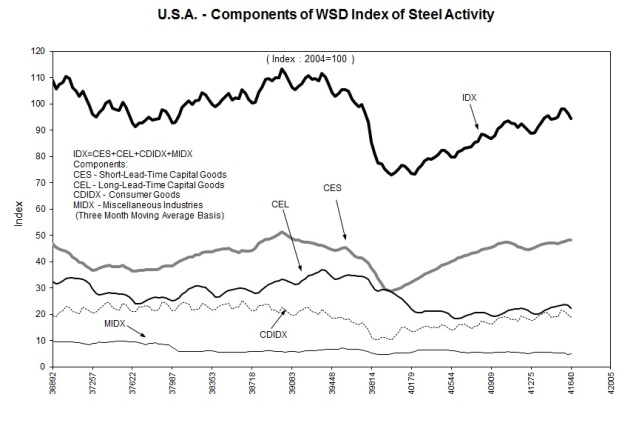

Since 2007, the largest year-to-year decline for the index was 30.3% in May 2009, while the biggest year-to-year gain was 13.6% in April 2012.

These IDX figures provide support to the concept that, at least for the moment, the US is the country, and the US steel market is the market, whose economy and steel industry outlook appear to be the most sustainable.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2014 by World Steel Dynamics Inc. all rights reserved