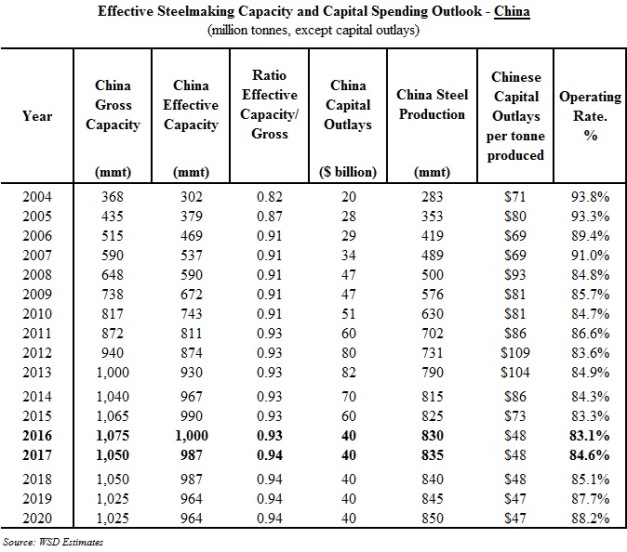

The Chinese steel industry in 2000-2013 experienced remarkable growth reflecting: a) the immense growth of steel demand in the country, as adjusted fixed asset investment as a share of GDP soared to about 48% from 35% in 2000; and b) the incredible array of steel plants and supporting facilities that were built fast and cheap. Chinese steel production in 2014 is forecast at 815 million tonnes versus 129 million tonnes in 2000 – a 14% compounded per annum growth rate over this period.

Looking ahead to 2020:

• Chinese steel production is forecast at 850 million tonnes, up just 35 million tonnes from 2014. One factor restraining steel production will be a massive decline in new apartment construction in the country. Residential construction activity currently accounts for about 26% of reported fixed asset investment in the country.

• Effective (real) steelmaking capacity may be about 964 million tonnes. This figure is little changed from the present time as the elimination of marginal plants about offsets the capacity additions.

• Capital spending falls back to about $40 billion or less. The figure is still enormous; but, far below $82 billion in 2013 and about $70 billion this year. On a per tonne produced basis, the steel industry’s capital spending by 2020 declines more than 50%.

• The effective (real) capacity operating rate rises to about 88% versus 84% in the current year.

This report includes forward-looking statements that are based on current expectations about future events and are subject to uncertainties and factors relating to operations and the business environment, all of which are difficult to predict. Although we believe that the expectations reflected in our forward-looking statements are reasonable, they can be affected by inaccurate assumptions we might make or by known or unknown risks and uncertainties, including among other things, changes in prices, shifts in demand, variations in supply, movements in international currency, developments in technology, actions by governments and/or other factors.

The information contained in this report is based upon or derived from sources that are believed to be reliable; however, no representation is made that such information is accurate or complete in all material respects, and reliance upon such information as the basis for taking any action is neither authorized nor warranted. WSD does not solicit, and avoids receiving, non-public material information from its clients and contacts in the course of its business. The information that we publish in our reports and communicate to our clients is not based on material non-public information.

The officers, directors, employees or stockholders of World Steel Dynamics Inc. do not directly or indirectly hold securities of, or that are related to, one or more of the companies that are referred to herein. World Steel Dynamics Inc. may act as a consultant to, and/or sell its subscription services to, one or more of the companies mentioned in this report.

Copyright 2014 by World Steel Dynamics Inc. all rights reserved