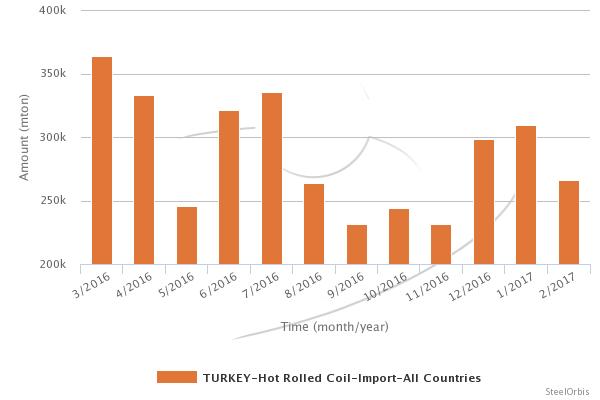

In February this year, Turkey's total hot rolled coil (HRC) imports decreased by 20.8 percent year on year to 266,047 metric tons, down 14 percent compared to January, according to the data provided by the Turkish Statistical Institute (TUIK). These imports had a value of $130.8 million, falling by seven percent month on month and up 26.9 percent year on year.

In the January-February period of the current year, Turkey's HRC imports amounted to 575,298 mt, down 24.6 percent, while value of these imports increased by 16.6 percent to $271.5 million, both year on year.

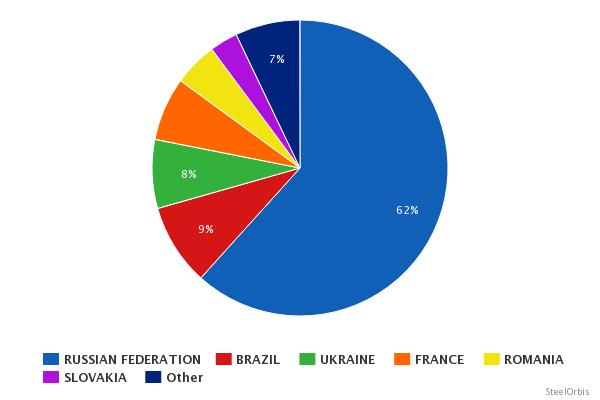

In the given period, Russia ranked first among Turkey's HRC import sources, with its HRC exports to Turkey amounting to 354,877 mt, up 14.63 percent year on year, followed by Brazil which shipped 51,271 mt of HRC to Turkey in the given period.

Turkey's top HRC import sources in the first two months of this year are as follows:

Country | Amount (mt) | |||||

January-February 2017 | January-February 2016 | Y-o-y change (%) | February 2017 | February 2016 | Y-o-y change (%) | |

Russia | 354,877 | 309,591 | 14.63 | 165,796 | 134,278 | 23.47 |

Brazil | 51,271 | 68,640 | -25.30 | - | 39,033 | - |

Ukraine | 43,209 | 70,698 | -38.88 | 21,337 | 44,332 | -51.87 |

France | 39,903 | 62,879 | -36.54 | 28,629 | 32,561 | -12.08 |

Romania | 27,624 | 55,578 | -50.30 | 13,322 | 22,178 | -39.93 |

Slovakia | 17,599 | 968 | - | 9,143 | - | - |

Belgium | 13,752 | 9,712 | 41.60 | 9,276 | 4,041 | 129.55 |

Turkey's main HRC import sources in the January-February period are as follows: