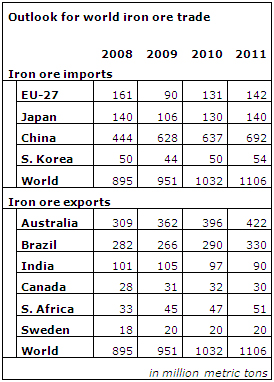

In 2010, world trade of iron ore is forecast to increase by nine percent to one billion metric tons, according to a report released by the Australian Bureau of Agricultural and Resource Economics (ABARE). This growth reflects increased steel production in China outpacing growth in domestic iron ore supply, and increased imports supporting recovery in steel production in many developed economies. In 2011, world trade of iron ore is forecast to increase by a further seven percent to 1.1 billion metric tons. The majority of increased trade in 2010 and 2011 is expected to be supplied by Australia and Brazil.

According to the report, although China is the world's largest importer of iron ore, it is also the world's largest producer. Because of China's significant domestic production and consumption, small changes in domestic iron ore production capacity utilization, and therefore import demand, have the potential to significantly affect the world seaborne market. Over the outlook period, China's production is expected to respond quickly to changing iron ore prices. If iron ore prices remain high, growth in China's domestic production is expected to offset growth in consumption, thereby reducing its reliance on imports. However, if iron ore prices decline significantly, China's production is expected to decline, increasing its reliance on imports from low cost producers in Australia and Brazil.

The report suggests that the global iron ore trade has been, and will continue to be, dominated by the two largest exporters: Australia and Brazil. As the majority of production from these two countries has a lower production cost compared with Chinese and Indian producers (on an equivalent iron content and import parity basis), Australian and Brazilian exports are forecast to increase over the next 18 months.

The report suggests that the global iron ore trade has been, and will continue to be, dominated by the two largest exporters: Australia and Brazil. As the majority of production from these two countries has a lower production cost compared with Chinese and Indian producers (on an equivalent iron content and import parity basis), Australian and Brazilian exports are forecast to increase over the next 18 months.

In 2010, Australian exports of iron ore are forecast to increase by nine percent to 396 million metric tons, primarily due to the ramp-up of BHP Billiton's Rapid Growth Project 4 expansion, which was completed in late 2009, and Rio Tinto's Mesa A development, which was completed in early 2010.

Australia's exports in 2011 are forecast to increase by a further seven percent to 422 million metric tons. Further significant expansions scheduled for completion in the next 12 months, such as Fortescue Metal Group's Chichester Hub expansion and CITIC Pacific's Sino Iron Project, are expected to contribute to this increase.

In 2010, Brazil's iron ore exports are forecast to increase by nine percent to 290 million metric tons. A significant proportion of this increase in production is expected to come from capacity that was idled in late 2008 and early 2009. Brazil's exports in 2011 are forecast to increase by 14 percent to 330 million metric tons. Growth in 2011 primarily reflects the ramp-up of a 10 million mt annual capacity expansion at Vale's Carajas operation and higher pellet production, which was more severely affected during the downturn.