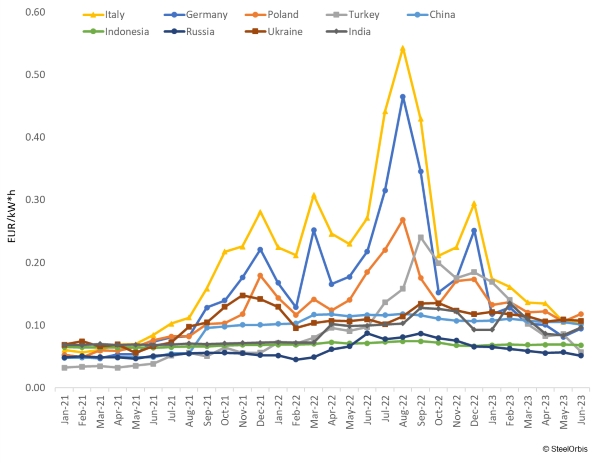

The share of Asian companies in the European flat products markets in 2022 increased to 15-16 percent from 10-12 percent in 2021. One of the main reasons for the growth of the presence of Asian companies in the European market was the increase in competitiveness due to lower energy costs. The war in Ukraine, unleashed by Russia, led to significant changes in the energy market worldwide, and primarily in European markets. Sanctions against Russian energy companies and the stoppage of natural gas supplies to Europe caused a shortage in the market and a significant increase in the prices of natural gas and electricity. The increase in energy prices had a significant impact on the Turkish market. Turkey is almost completely reliant on imports to meet its natural gas and oil needs and domestic demand has risen since the Covid-19 pandemic. The rise in global energy prices in 2022, as well as the lira's sharp decline - by 27 percent in 2021 and more than 85 percent in 2022 - have stoked prices domestically.

Electricity prices in countries that supply flat products to Europe

At the same time, the Asian markets were not affected by any significant increase in energy prices. Asian countries continued to buy Russian natural gas and oil at huge discounts.

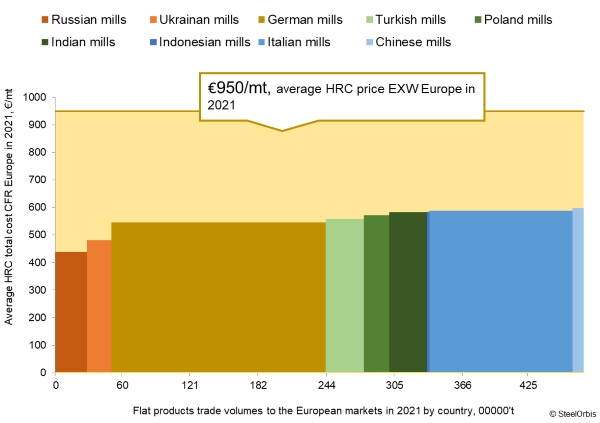

In 2021, the cost of Asian flat products with delivery to Europe was higher than the prices of material produced in Europe.

Average HRC prices of suppliers to Europe in 2021

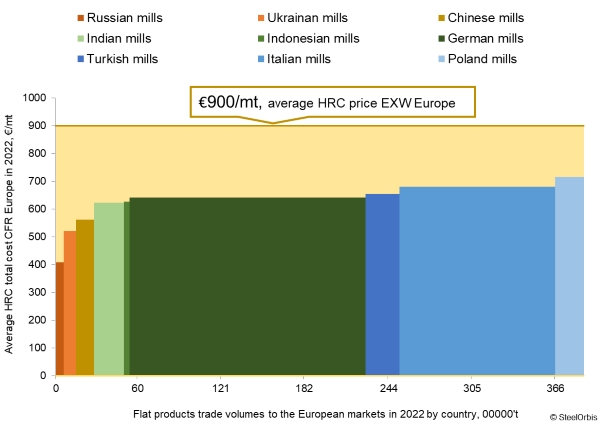

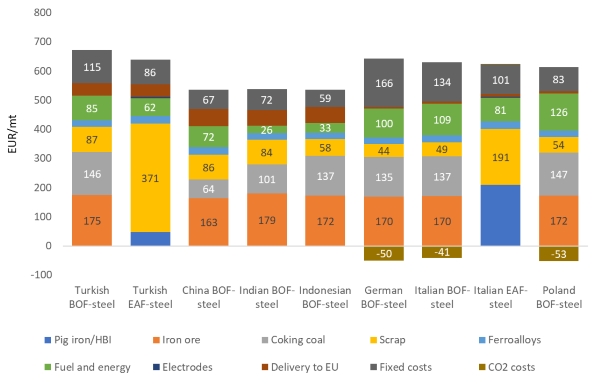

But in 2022, the situation changed. Higher energy prices in Europe led to a 15-25 percent increase in the production costs of flat rolled products. The cost of Turkish material increased by 20-24 percent. At the same time, Far Eastern countries were not hit so hard by the increase in energy costs. The cost of flat rolled products from Asia even decreased by 5-10 percent on average in 2022, due to the reduction in iron ore costs.

Average HRC prices of suppliers to Europe in 2022

In 2023, energy prices in Europe have decreased significantly, but Asian flat product prices are still lower than European and Turkish flat product prices.

Average HRC price including delivery to EU in first half of 2023

This led to an even greater increase in the share of Asian suppliers in 2023 to 17-19 percent. The outlook for the third quarter of the year seems to be negative for European and Turkish producers due to the price pressure from aggressive steel offers from Far Eastern countries which have not been hit so hard by the increase in energy costs.