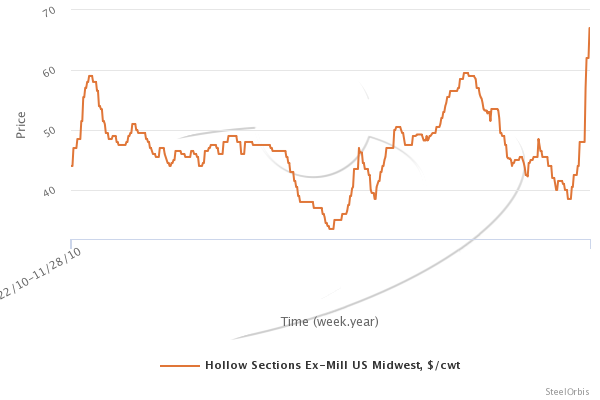

In the days leading up to Christmas, spot market prices for US domestic hollow structural section (HSS) steel were shooting up at breakneck speed. Tube mills announced two separate $5.00 cwt. ($110/mt or $110/nt) price increase announcements between Dec. 2 and Dec. 11, and it was widely speculated that additional increases would be announced in early 2021.

Both December increases were accepted, and before the holiday break, US HSS spot market prices rose $61.50-$62.50 cwt. ($1,356-$1,378/mt or $1,230-$1,250/nt), FOB mill. At that point, prices were higher than they were during their post-Section 232 peak, when, in July 2018, spot market prices climbed to a staggering $60.00 cwt. ($1,323/mt or $1,200/nt) FOB mill.

Since that time, US HSS prices have continued to climb. Scrap prices in the Northeast have settled up by $80-$120/gt over December settled levels, and while Midwest prices have not settled yet, it’s believed they’ll hit a similar mark. Not surprisingly, tube mills have pushed out yet another $5.00 cwt. ($110/mt or $100/nt) price increase. The increase, which was announced by multiple mills earlier today, takes effect immediately.

This will put US HSS prices in the range of $66.50-$67.50 cwt. ($1,466-$1,488/mt or $1,330-$1,350/nt), FOB mill.

“The mills are basically printing money at this point, and they’re making bank, that’s for sure,” a service center source said. “We bought heavy going into this, but warehouses aren’t big enough to put enough steel in it to stock you for an entire quarter. We’ll likely start to need to replace inventory in about 1.5 months, but at that point, if prices are still where they are, we’re not going to go crazy buying steel.”

Another source agreed. “We’ve made fantastic margins because we’ve had low-cost inventory, but that’s not going to last forever. The market went up so fast that you can bet your bottom dollar that when the market cracks, it’s going to shoot down just as fast,” he said. “Everyone is going to bleed at that point and all you can do is to try to minimize the blood loss. Markets like this are a lot of fun on the way up, but there’s always spikes at the bottom of the pit on the way down.”