US domestic tubing mills aren't collecting their latest price increase just yet, as demand and buying activity have remained stagnant.

Just as US domestic hollow structural sections (HSS) spot prices appeared to be on a downward slope and poised to continue falling into September, mills announced an immediate price increase. Atlas and Independent Tube led US domestic tubing mills with a $3.00 cwt. ($66/mt or $60/nt) increase on all new HSS orders on August 19, a move quickly followed by other producers such as Bull Moose Tube and Southland Tube. While neither Atlas nor Independence Tube gave a reason for the increase, Bull Moose Tube indicated that it is a result of rising raw material costs--in the week prior to the announcement, US domestic flat-rolled mills had issued an immediate price increase for $3.00 cwt. on all new orders.

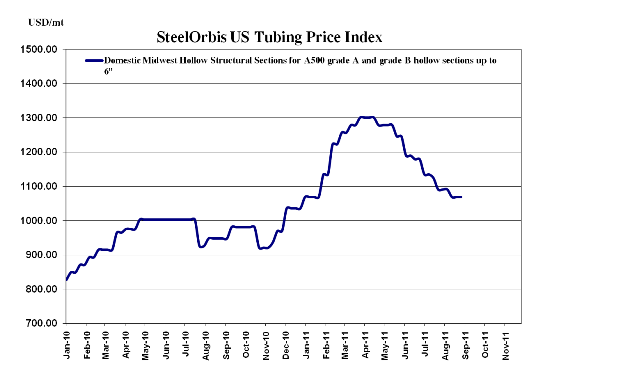

Reactions to the tubing price increase from market players remain fairly skeptical, however, considering that only about $1.00 cwt. ($22/mt or $20/nt) of the flat-rolled price increase has been absorbed so far, and tubing demand remains depressed. For now, industry insiders indicate that there hasn't been any rush to place orders in anticipation of higher HSS spot prices, although the increase did push buyers who had been sitting on the fence to place necessary orders. If domestic hot rolled coil (HRC) spot prices do increase more substantially, HSS spot prices will likely rise as well, but for now, most HSS orders are still being placed in the range of $48.00-$49.00 cwt. ($1,058-$1,080/mt or $960-$980/nt) ex-Midwest mill--showing no movement from two weeks ago.

As for imports, because of the Ramadan holiday in the Middle East, Turkish tubing offers for the US have quieted, but new offers aren't likely to be of any interest to US buyers anyhow. The last Turkish prices heard two weeks ago were approximately $44.50-$45.50 ($981-$1,003/mt or $890-$910/nt) DDP loaded truck in US Gulf ports after falling about $2.50 cwt. ($55/mt or $50/nt) from July prices. Traders tell SteelOrbis that Turkish mills are currently attempting to raise domestic HRC prices, and if they're successful, then Turkish export HSS prices will increase as well, making imports even less attractive to US buyers.