Following a number of interviews carried out by SteelOrbis in the past week in important regions for the flats market in Turkey such as Eregli, Bursa, Istanbul, Iskenderun, Izmir and Kayseri, it may be said in general that although some improvement in demand is currently being observed in the Turkish flats market, due to the difficult situation they find themselves in many companies are lowering their prices as they seek to gain an edge on domestic competitors. Thus, flats prices are not increasing in this market. In the local Turkish flats market, Erdemir production 2 mm material is being sold by local firms at $500-520/mt, whereas the Ukraine origin material is being sold at $460-480/mt. Meanwhile, looking at Europe, HRC prices are in the range of €360-380/mt.

Due to the financial problems experienced against the background of rapid price decreases and consequent losses suffered, firms are delaying debt repayments. Such payment delays appear likely to continue until the current hard times come to an end, and, in the upcoming months most firms are expected to experience difficulties apart from those that continue to sell material and to pay their debts. There are two requirements for the alleviation of this situation - First, end-user sectors (whose stock levels are expected to decline in the third or fourth month of the year) will hopefully buy for their needs in the months in question. Second, the financial markets will first need to regain confidence, followed by a reopening of the credit-flow channels in the real sector and a resumption of cash flow. However, as steel consumption will be lower this year, it is naturally expected that the recoveries will be for short periods and at slower rates. For a recovery such as the above to become reality, it is of the utmost importance that banks should fully pass on the central banks' interest rate cuts to their customers and should open the credit channels. The current financial crisis could get worse in the event of any measure or action that has the effect of reducing consumption levels. Banks should also realize that they are doing harm to themselves by their natural reflex in any crisis, i.e. to be excessively cautious in issuing credit due to a lack of confidence. The banks should simply choose the most suitable and healthy firms as the beneficiaries of credit and thereby aim to relieve the sector.

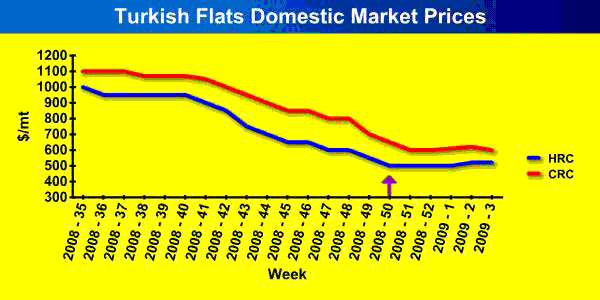

What will price levels in the local Turkish flats market be like in the upcoming period? The question is really hard to answer. For the time being, as seen in the price chart below, the supply-demand balance is stable right now and the price levels have been stable for five weeks in a row without showing any decrease.

Producers have cut their production by 40-50 percent in the last two months and have correspondingly decreased their supplies. As a result, prices have been stabilized and remain stable but yet no demand recovery is in sight. If no supply increase is registered, prices will remain flats at the current level of demand. However, with the arrival of spring it is expected that demand for flats will recover but not as much as compared to last year. In particular, firms that have not yet given orders for 2009 will start to buy new material after they have melted down their stocks. Thus, sectors such as automotive, machinery, white goods and shipbuilding are likely to buy in material, though in reduced quantities compared to last year. If production (supply) does not increase, prices may start to rise. If supply increases in line with demand, then prices will likely move on a stable trend with perhaps a slight increase. However, the worst scenario would be one of over-production in response to increasing demand. Most firms in the local Turkish flats market would not be strong enough to survive another wave of serious crisis.

When looking at all the data, it is observed that overall price levels are not falling below certain levels and that no change in this trend is likely as long as there is no big change on the supply side. However, it is also certain that big economies such as China and the USA will invest in their local markets and in infrastructure projects in order to activate their economies. For this reason, it is possible that global steel consumption will see a recovery. The most important question at this point is this: Will the producers be successful in maintaining an appropriate supply-demand balance in 2009? It is expected that the producers, which have been incurring losses for six months now, will likely want to have a piece of the cake. Thus, it will not be surprising to see prices fluctuate during the current year depending in general on the supply levels.