While the US plate market continues to be dominated by excess inventory and low demand levels, domestic mills may announce another price increase this month, as a result of climbing busheling scrap prices.

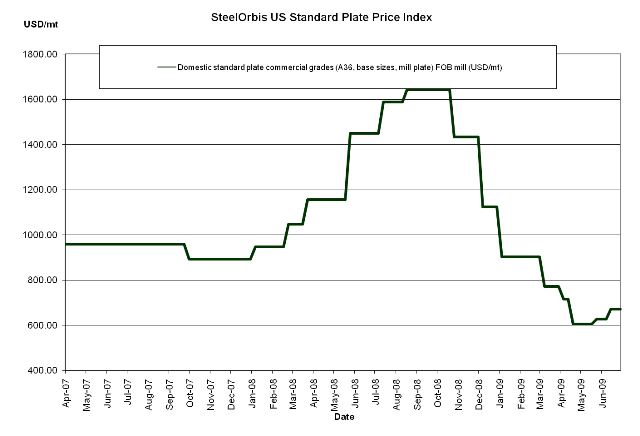

However, while US busheling scrap prices have increased by as much as $80/lt ($81 /mt or $90 /nt) this month depending on region, any domestic plate price increase is expected to be slight in comparison. Most distributors have the mentality that any domestic mill increase of plate prices will be an attempt to get the current transaction price range to stick. For the time being, domestic plate transaction prices continue to range from approximately $30.00 cwt. to $31.00 ($661 /mt to $683 /mt or $600 /nt to $620 /nt) FOB mill in the Midwest for commercial grades (A36, base sizes, mill plate). However, spot prices are still being negotiated for discounts of about $2.00 cwt. to $3.00 cwt. ($44 /mt to $66 /mt or $40 /nt to $60 /nt) below published prices.

Despite some increased activity in July, distributors have informed SteelOrbis that demand is still "anemic" and most customers are booking merely to fill gaps here and there, with no intention of booking again in the near future.

However, according to the most recent Metal Service Center Institute (MSCI) monthly shipment and inventory report, there may be a small silver lining, as daily shipments of plate tonnage increased from 10,500 nt in April to 11,100 nt in May, and de-stocking efforts pushed inventory levels all the way down to 795,000 nt, thus improving the average inventory overhang to 3.6 months, the lowest it's been since November 2008.

Meanwhile, import plate offers to the US are not even on the radar for most traders. While service center inventories may have trimmed down, there continues to be an abundance of unsold plate tonnage, in a variety of sizes, on the ground at multiple US ports. One trader told SteelOrbis that he currently has plate tonnage spread out over a couple different Gulf ports that he is trying to sell at a "premium" discount. With little demand for the imports already on the ground, there is certainly no interest and no immediate need to book new plate orders from overseas right now.

Preliminary license data from the US Import Administration demonstrates that import tonnage of cut-to-length plates decreased further in June, to 21,805 mt, from 26,398 mt in May. Canada lead the way with 12,770 mt in June, while the only other foreign source to export over 1,000 mt was Sweden, at 1,742 mt.