The balance sheets of integrated steel plants across the globe were worse than expected in the first quarter of 2009 due to the average decrease of 40 percent in finished steel product prices compared to the last quarter of 2008 and also due to production cuts reaching almost fifty percent. However, Indian flat product demand has showing a better performance compared to global trends in terms of both tonnages and prices. Looking at the World Steel Association global steel output data, it is expected that global steel output will decline by 22.9 percent in 2009, whereas a production drop of only 8.1 percent is expected in India. Meanwhile, according to the same data, India's steel output will register only an 8.1 percent decrease in 2009, with the global figure on the other hand expected to fall 22.9 percent. Furthermore, with World Steel Association apparent steel use (ASU) data projecting a 1.7 percent growth in the country's steel consumption in 2009 due to its low per capita steel consumption at present of about 45 kg compared with the global average of 200 kg, India is expected to be one of the few markets to post an increase in a year that will see global consumption of the metal fall by around 15 percent.

According to the Joint Plant Committee data (the official custodian for iron and steel data in India), 22.5 million mt of flat products (HR coil/strip/sheets, CR coil/sheets and galvanized coil/sheets) were produced in India from April 1, 2008 to March 31, 2009, whereas apparent consumption stood at 23.3 million mt of flats from April 1 last year to February 28 this year.

India has not yet reached the levels of China as a steel production center. However, it is an interesting point (in terms of the long-term room for steel production expansion in India) that China produces ten times more steel than India, while India's population is only fifteen percent less compared to China's. Thus, expectations as regards the steel sector in India are fairly optimistic since a situation of oversupply has not yet been seen, since local demand is at present showing strength, and as India still has to increase its currently limited position in the global steel business.

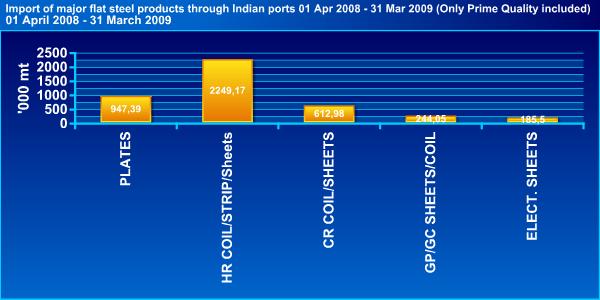

Import trend of flat steel products through major Indian ports:

Flat Products | 01 APR 2007 - 31 MAR 2008 Import | 01 Apr 2008 - | %Change | April08-Feb09 | April08-Feb09 Apparent | Diff |

PLATES | 1416,92 | 947,39 | - 33,14 | 3452 | 4047 | -595 |

HR COIL/STRIP/ SHEETS | 2850,72 | 2249,17 | - 21,10 | 10717 | 11811 | -1094 |

CR COIL/SHEETS | 680,09 | 612,98 | - 9,87 | 4195 | 4530 | -335 |

GP/GC SHEETS/COIL | 195,14 | 244,05 | 25,06 | 4163 | 2996 | 1167 |

TOTAL (2) Flat Products | 5424,47 | 4321,84 | -20,33 | 22527 | 23384 | -857 |

Quantity: '000 mt / Sourced from Joint Plant Committee / Summarized by SteelOrbis

As is clear from the above table, total plate and hot rolled product imports have been maintaining their levels even though hot rolled imports have decreased by 21.1 percent and plate imports have decreased by 33.14 percent when comparing April 2008-March 2009 to April 2007-March 2008.

Quantity: '000 mt / Sourced from Joint Plant Committee / Summarized by SteelOrbis

Quantity: '000 mt / Sourced from Joint Plant Committee / Summarized by SteelOrbis

End-users and cold rolled producers have reacted negatively to the appeal made by Essar Steel and Ispat Industries to the government for an increase in the import duty from five percent to fifteen percent, especially as the current import legislation only allows rollers and end-users to perform imports. Chinese origin flat steel imports to India totaled 1,066,470 mt in April 2008-March 2009, with HRC accounting for 847,710 mt of this figure. However, in the time period in question total HRC imports have decreased by 23 percent, whereas Chinese origin HRC and South Korea origin HRC imports have decreased by ten percent. Considering only HR coil/strip/sheets, CR coil/sheets and galvanized coil/sheets, in the twelve-month period in question flats imports decreased by 20.33 percent year on year to 4.3 million mt.

Quantity: '000 mt / Sourced from Joint Plant Committee / Summarized by SteelOrbis